Addepar is a wealth management solution that will transform your approach to data and analysis — giving you the precision and flexibility to deliver more for the portfolios in your care.

0

assets managed

on Addepar

0

users in 52+ markets worldwide

0

of users saved time on custom reporting

0

direct data feeds from custodians and fund administrators

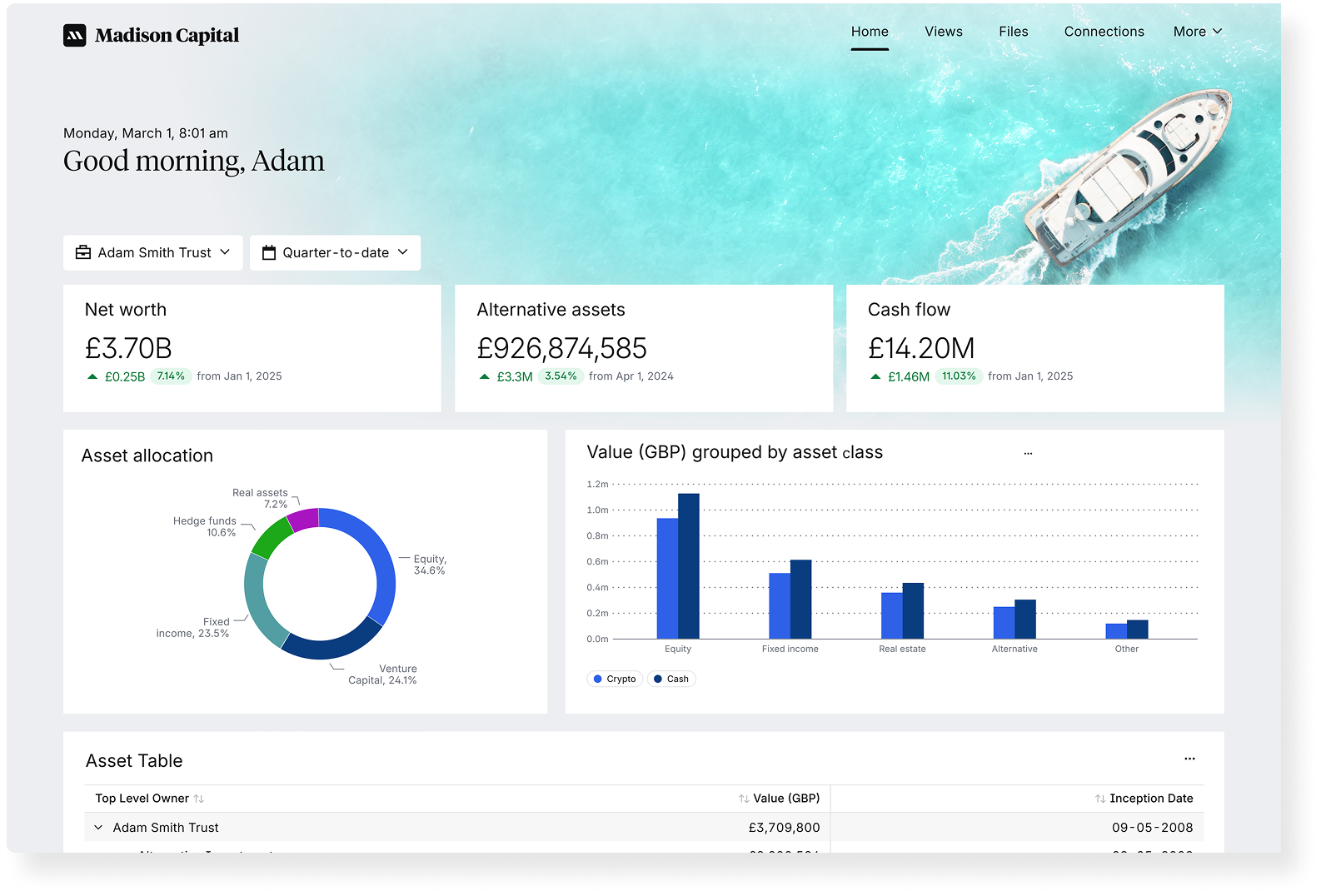

A single source of truth

Increase accuracy and empower smarter investment decisions

-

Quality data management

Automate data aggregation and leverage our best-in-class verification process to enhance data quality. Benefit from Addepar’s integrated data feeds and see every asset, all in one place. -

Timely, data-driven insights

Gain a holistic view of client portfolios or drill down into any level of granularity to deliver timely insights and better portfolio performance analysis. -

Stronger client relationships

Enhance client communication using the Addepar Client Portal to easily share data-driven insights and reports. Optimise every view to deliver information in the format you — and your clients — prefer. -

Flexible, custom reporting

Easily create bespoke, up-to-date reports in minutes with our drag-and-drop report builder. Build new or use out-of-the-box templates, quickly customised with your firm’s branding.

TRUSTED LOCAL EXPERTISE

Making our global presence local

Tailored to meet the specific needs of our network in the region, we provide localised data server hosting in Europe, delivering speedy data access and enhanced data security. Plus, with Addepar offices in London and Edinburgh, benefit from expert teams on the ground — aligned with operational hours and equipped with in-depth knowledge of the regional wealth management landscape.

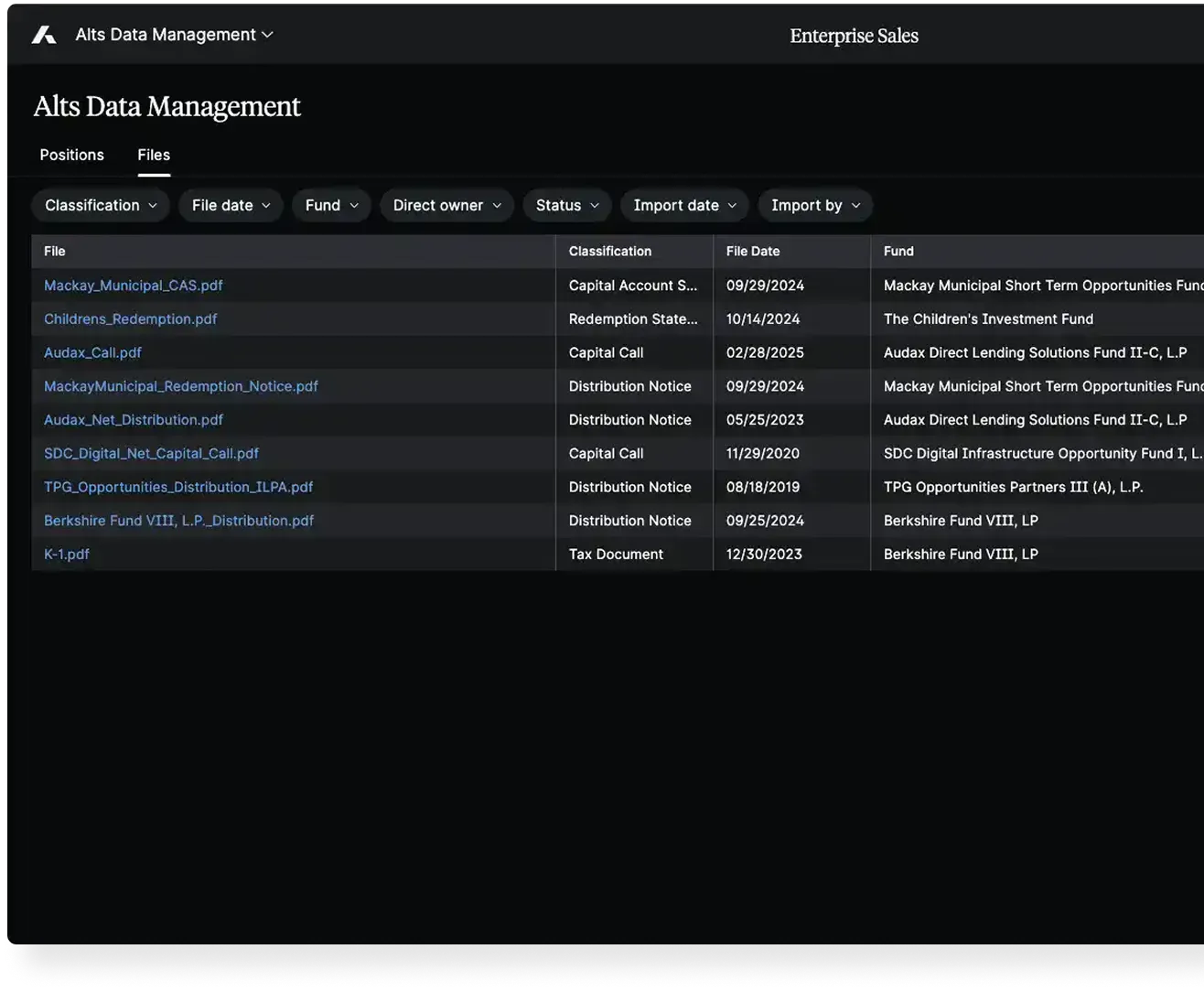

Take your alternatives data management to the next level

Manage your alternatives with ease, with Addepar’s automated alternatives management tool. Benefit from a blend of AI-enabled technology and human oversight to mitigate risk, creating a best-in-class verification process. Say goodbye to manual processes and streamline your workflows.

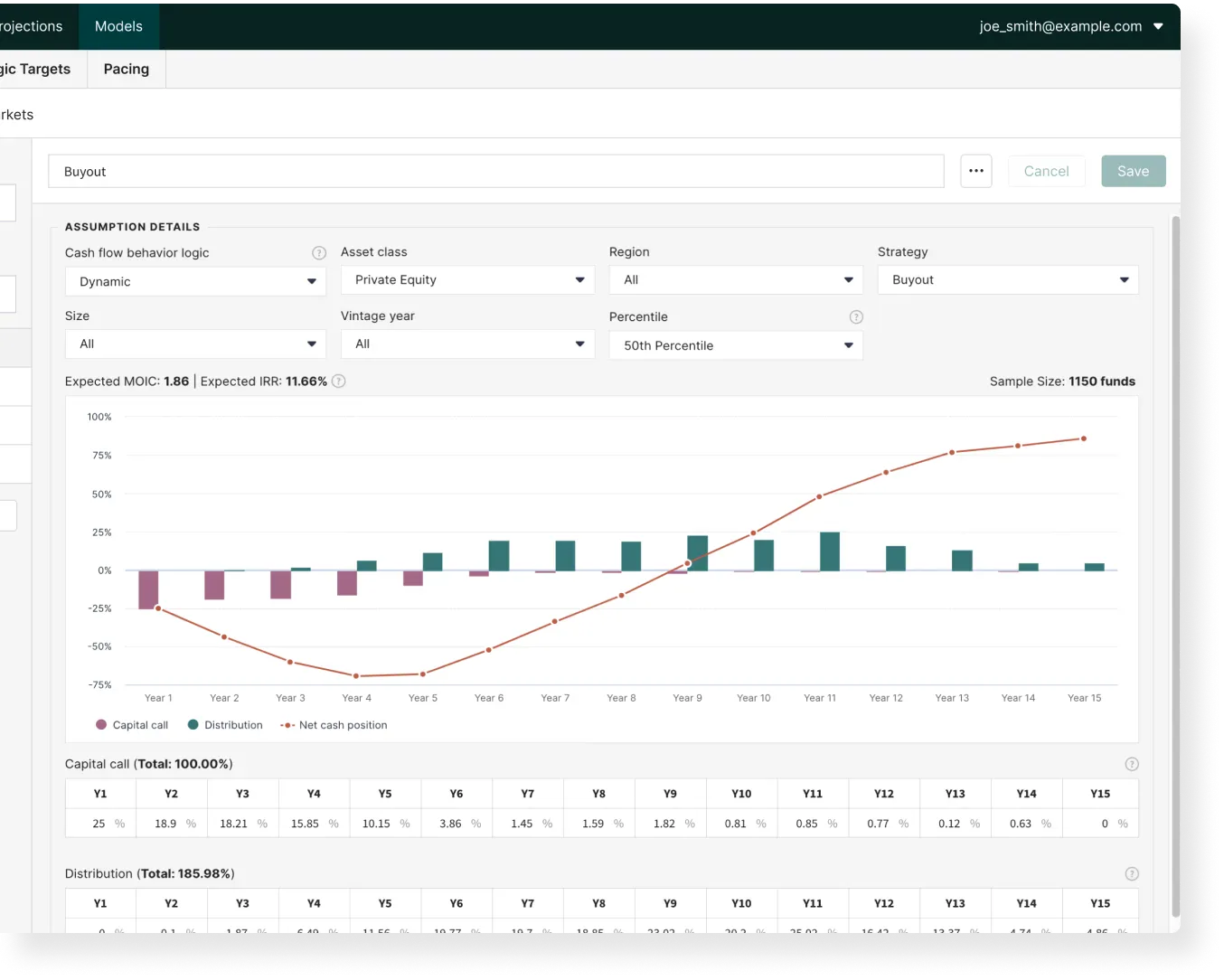

Go further with our total portfolio projection solution

Leverage Addepar’s complete forecasting and modeling tool — allowing you to simulate scenarios and forecast private fund cash flows across different private market assets. Get ahead of complex private market investments with granular, tailored analysis.

Transition with ease

Move on from your legacy system while minimising disruption, with Addepar's onboarding and implementation process — tailored to meet the needs of your firm.

Harness the support of our expert onboarding team, to make sure you can hit the ground running.

Access all-hours support throughout the week

Access all-hours support throughout the week from a team of finance and technology experts, through the platform or by phone.

Partner with a dedicated client manager to help your firm maximise success with Addepar.

Leverage open APIs

Seamlessly integrate with almost any proprietary or third-party technology with our suite of open APIs, and spend less time moving between systems for enhanced efficiency.

Access our expanding library of established tech, data and services partners, providing your firm with a solution to most use cases.

Frequently asked questions

Yes, Addepar is designed to handle even the most complex investment portfolios. Our platform aggregates and analyses data from various sources, including alternative investments, to provide a holistic view of your clients' wealth. You can confidently manage diverse asset classes and investments.

Addepar offers customisable reporting and client engagement tools. You can create branded, client-specific reports and dashboards that showcase your value and insights. This enables you to engage clients more effectively and demonstrate your expertise.

Addepar takes data security and compliance seriously. We employ industry-standard encryption and access controls to protect your data. Our platform also supports compliance reporting and helps you adhere to industry regulations.

Addepar offers ongoing support to ensure your success. During onboarding, you'll have access to our support team, and we'll provide comprehensive training resources. Additionally, get access to our on-demand Help Centre and online training portal to kickstart your experience. Once you’ve hit the ground running, continue to partner with a dedicated client success manager to oversee your long-term journey and help to maximise your success.

Our Integration Centre features an expanding group of providers, empowering you to connect Addepar to connect with best-in-breed tools across a wide variety of categories from CRMs to risk management. We also have a suite of open APIs and resources to develop new solutions and seamlessly integrate Addepar with almost any system or workflow, proprietary or third-party.

Increase efficiency with Addepar

Do you want to integrate alternatives, automate data aggregation, and create bespoke reports in minutes?

Thank you!

We have received your request

We will reach out to you shortly.