Navigator led to transformational improvements for Sage Mountain in key areas

Enhanced client communication and confidence

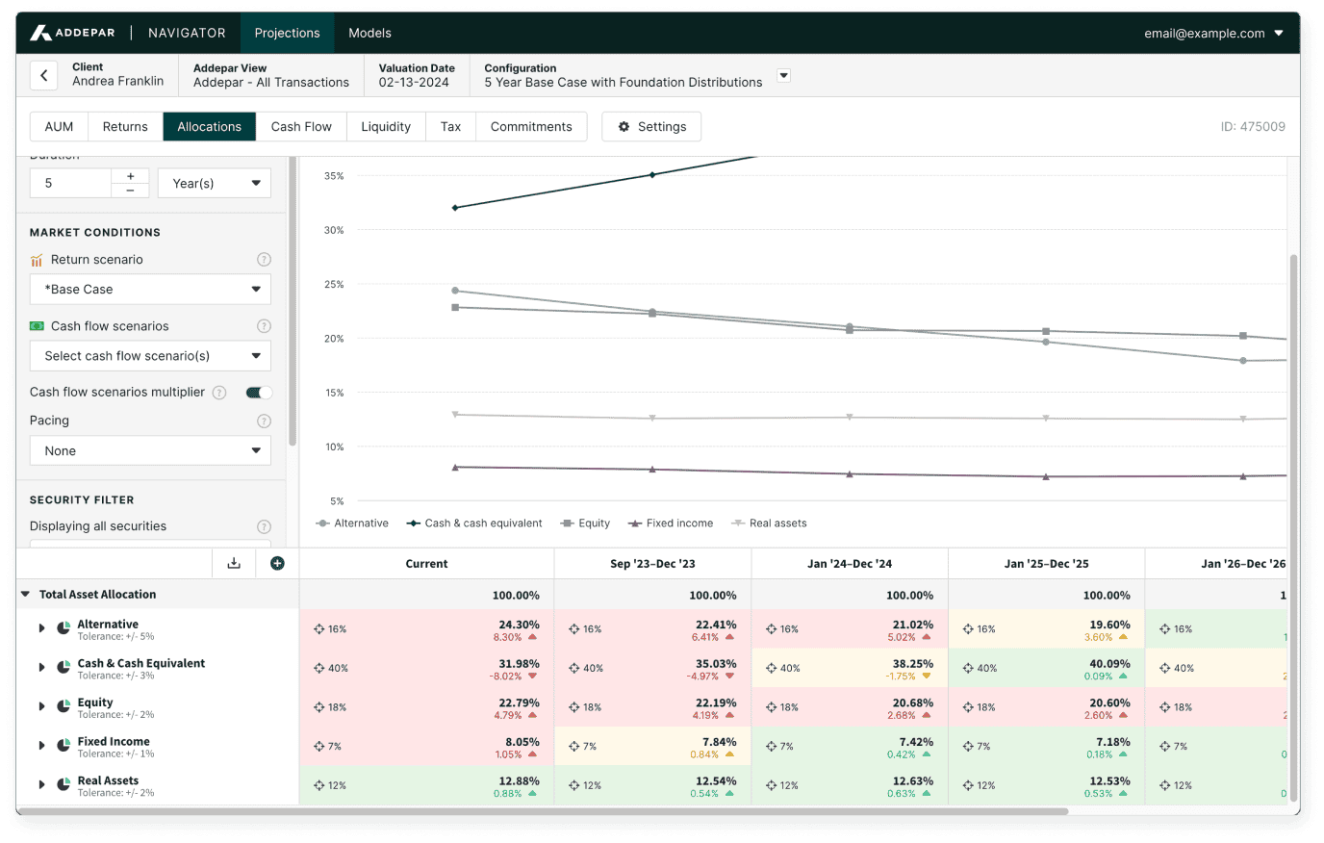

Sage Mountain has found that Navigator reports greatly improve client communication. For example, quarterly reports include clear visualizations of allocation percentages, helping clients understand how their alternative portfolios are performing and where their capital is invested. Senior Portfolio Manager John Darby highlighted how clients who previously relied on rough estimates now receive more precise, data-backed projections, making them more comfortable with long-term commitments to illiquid assets.

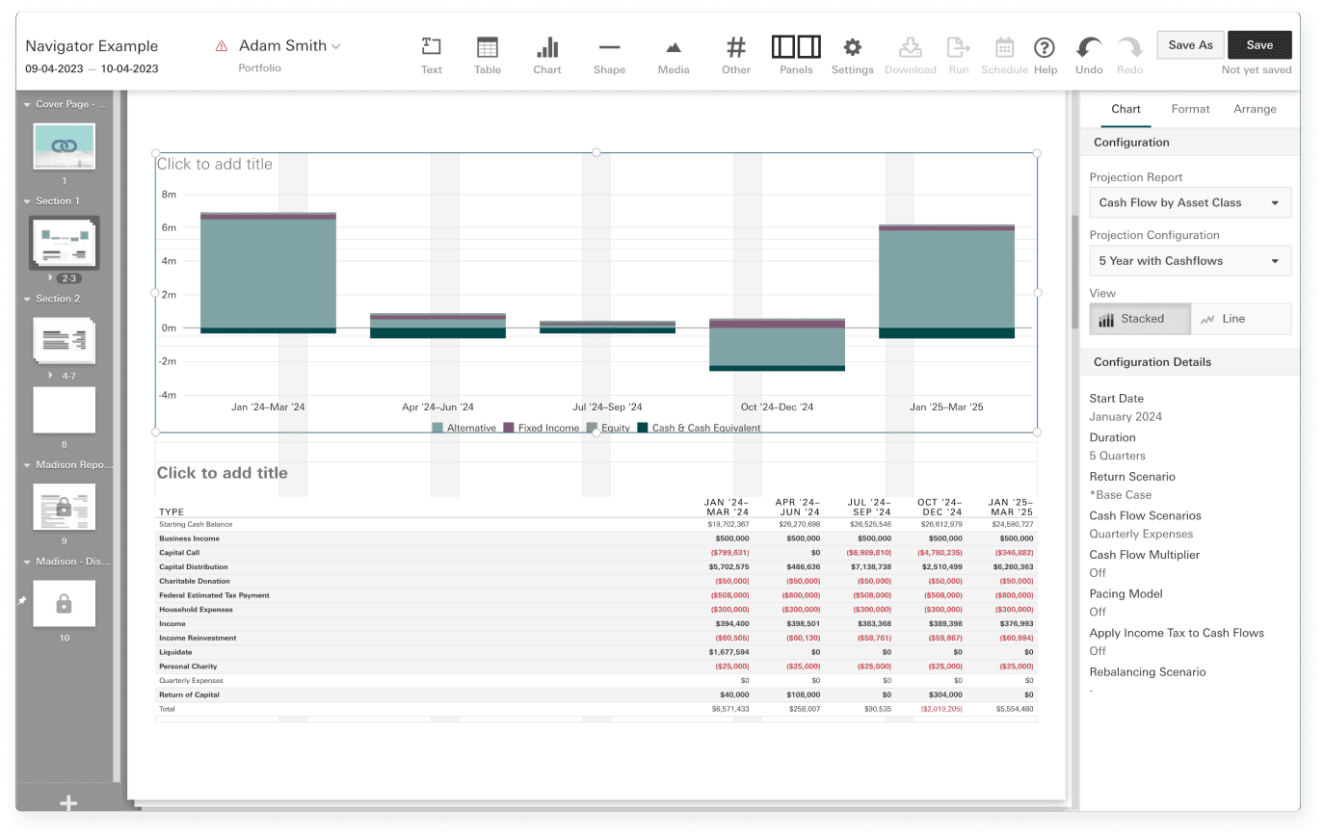

Incorporate Navigator’s projections into existing Addepar report templates

Increased operational efficiency

With a team of 25, Sage Mountain needed a solution that would ensure consistency across all advisors. Navigator significantly boosted the firm's operational efficiency by automating manual tasks and pulling live data from Addepar, providing a full financial picture for clients. The ease of refreshing reports ensures that all team members work with the same assumptions. Manually updating complex cash flow projections could take over an hour, but with Navigator, these updates now take just minutes, reducing routine workload by 91% and improving scalability.

Tony Cox remarked, “Having portfolio projections in a format that we can just refresh and show clients with some real numbers behind them has been really, really helpful.”

Supports closing new business

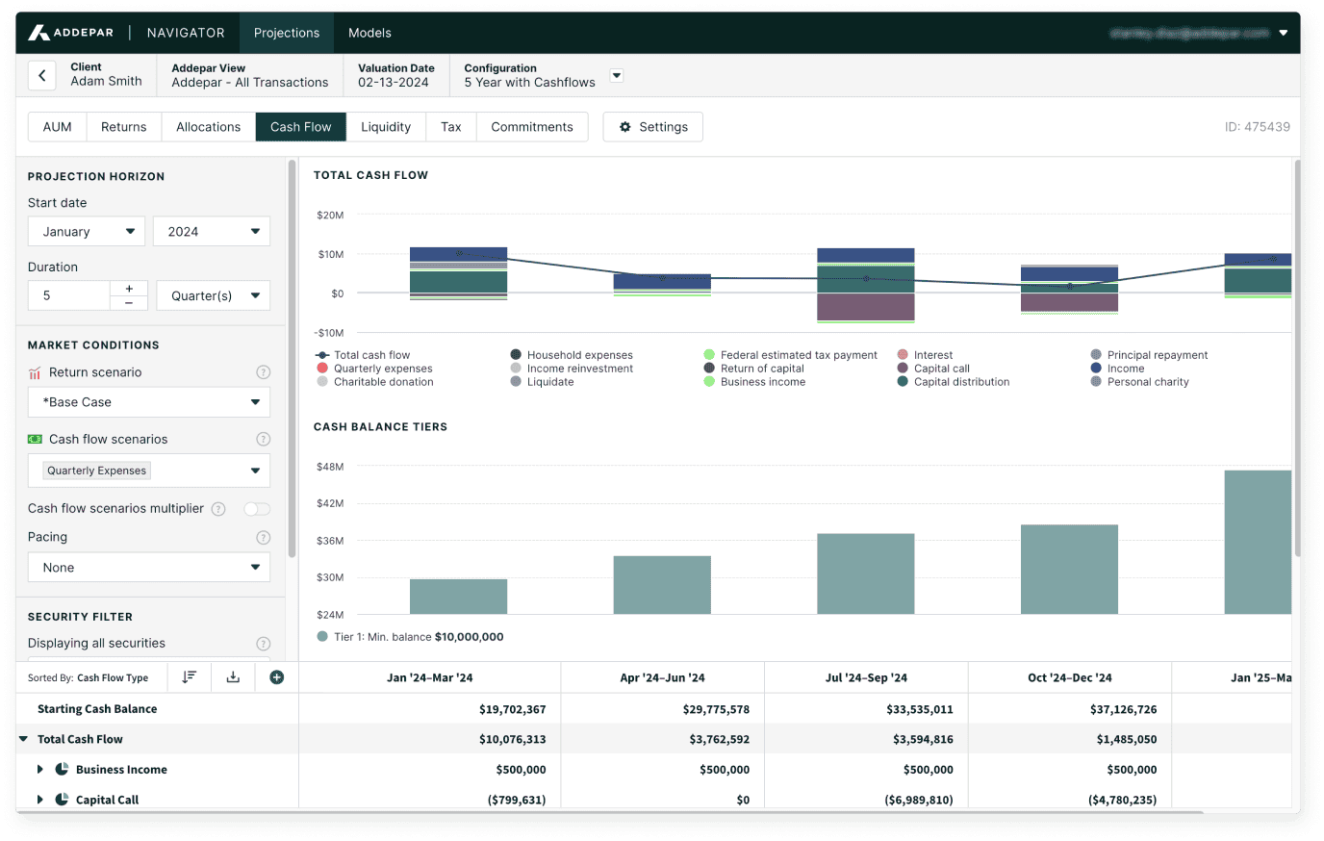

Navigator has significantly improved Sage Mountain’s ability to win new business. For instance, when competing for an RFP from a $150 million endowment, Navigator allowed the firm to present a detailed alternative investment strategy. They created granular projections by sub-asset class (e.g., private equity, venture capital, private debt), rather than treating alternatives as a whole. Similarly, Sage Mountain used Navigator to secure new business in the liquidity management space, where the platform’s ability to project various liquidity scenarios was pivotal in winning the client. Tony Cox expressed confidence, saying, “We can really help you plan around your liquidity situation,” and this was “a big part of the reason why we won.”

Better decision-making in alternative investments

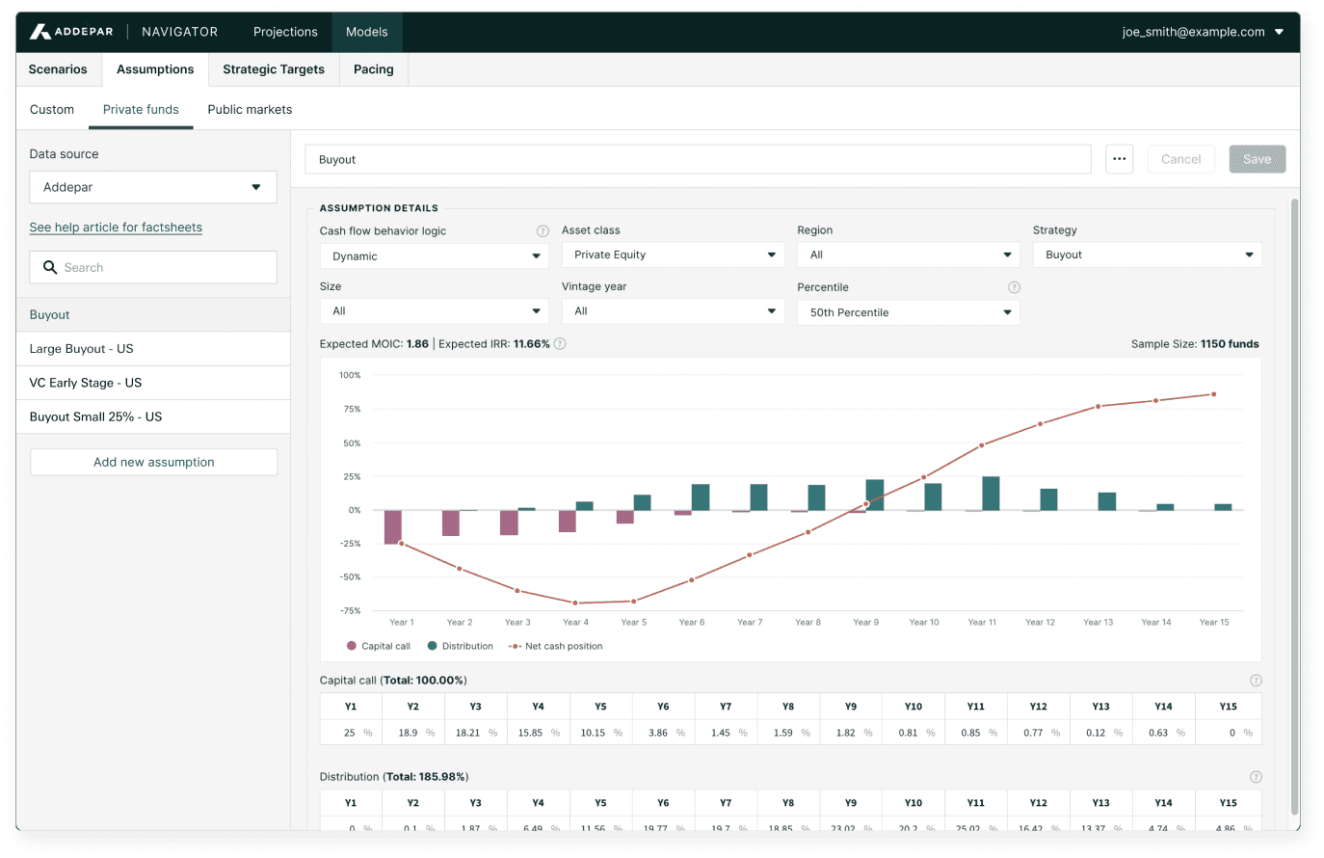

Sage Mountain’s decision-making frameworks for alternative investments improved significantly with Navigator. Previously, clients often set aside excess cash, unsure how to time their alternative investment commitments. Navigator’s pacing models allowed Sage Mountain to project capital calls and distributions accurately, enabling clients to stay fully invested without unnecessarily holding cash. For example, Tony Cox mentioned that Navigator helped clients understand when and where future commitments could be funded through existing portfolio cash flows, ensuring optimal allocation without liquidity concerns. This proactive approach allowed them to maintain a balanced portfolio, even as alternatives fluctuated in value or timing.

Understand future commitments to maintain a balanced portfolio with cash flow projections