View a complete picture of your clients’ wealth including multi-asset class portfolios, alternative assets and assets custodied elsewhere with Addepar. When you can see the full picture, you know exactly what you’ll do next.

0

assets managed on Addepar

0

users in 52+ markets worldwide

0

of Addepar’s 1,000+ employees are dedicated to R&D

0

direct data feeds from custodians and fund administrators

FOR PRIVATE BANKS

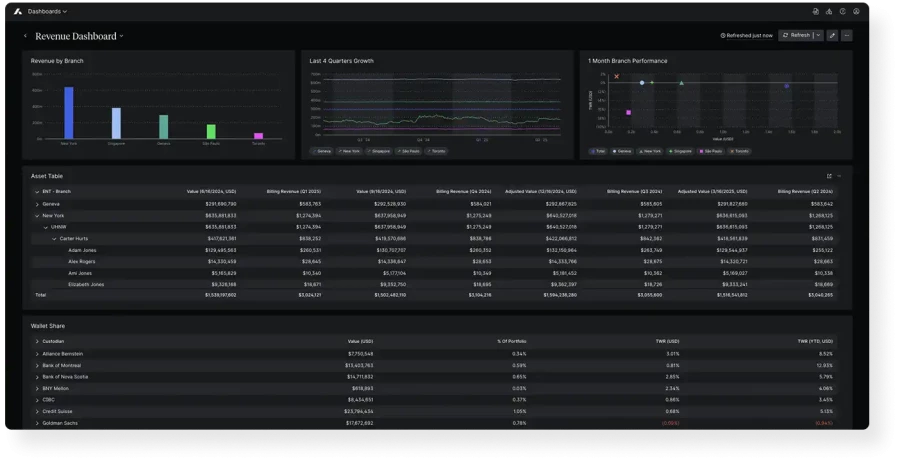

Addepar powers a personalized experience that can translate into a competitive advantage

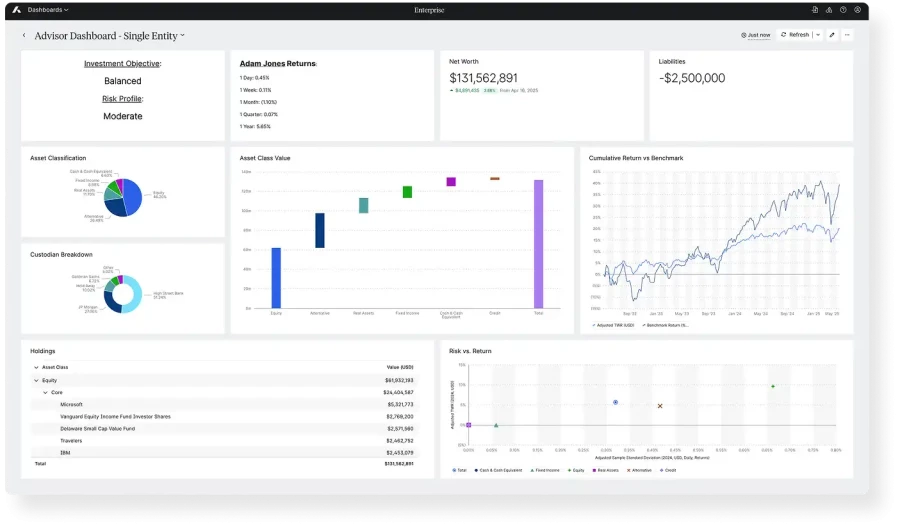

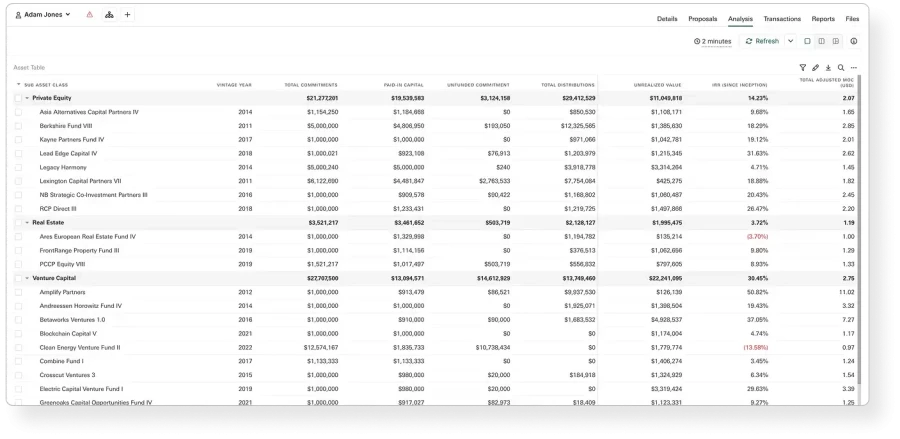

Addepar aggregates all financial accounts across every relationship to give you a consolidated view of your clients’ portfolios.

Leverage the flexibility of Addepar’s data model to show assets and ownership structures in the way you prefer.

View client investments easily across multiple custodial accounts and uncover opportunities to grow your relationships.

Perform more complete analyses and report in more depth with portfolio data that includes alternative assets and assets held elsewhere.

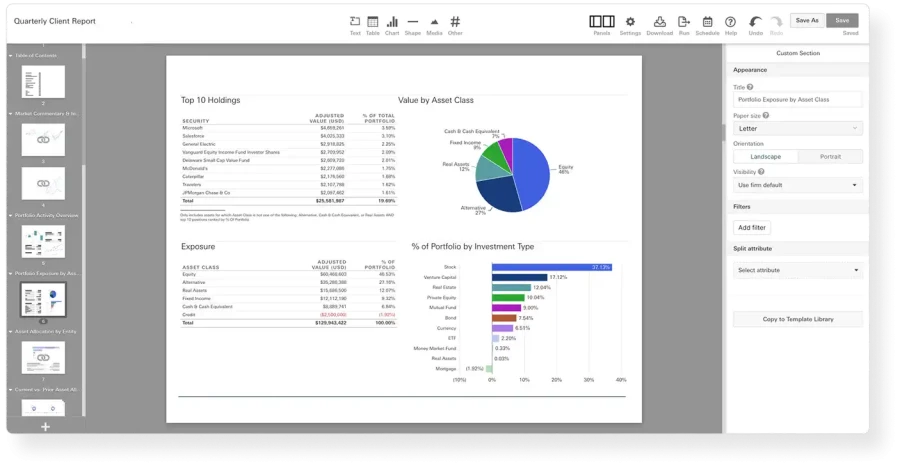

Our industry-leading private banking solutions allow you to tailor reporting insights in just a few clicks, saving you time for higher value client activities.

Analyze and visualize portfolio data instantly, including liquid and illiquid client portfolios, and respond quickly to market changes.

Strike the right balance of reporting customization and scalability, with self-service templates and tooling available to customize reporting on the fly.

Reports can be white labeled or team branded via PDF or portal, presenting an extension of your brand to your clients.

Set different dashboards to view client portfolio data holistically and as snapshots, then determine next steps.

Use prebuilt dashboards within Addepar to promote easy adoption by your internal teams.

Turn dashboard permissions on or off to make them available to team members based on compliance parameters.

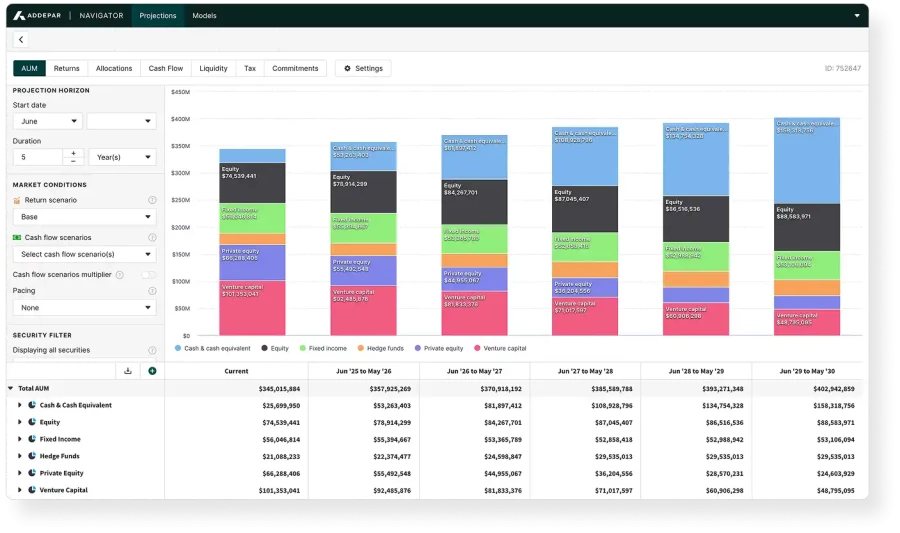

Visualize projected liquidity and future private market commitments with Addepar Navigator.

Simulate scenarios and forecast cash flows across all investment types in far less time and with greater accuracy.

Use precise pacing to reduce cash drag and seize the opportunity for greater returns.

Integrate alternative investments, marketable securities and personal collections — from private equity to venture capital, real estate and family businesses.

Navigate complex ownership structures, trusts and legal entities with dynamic, visual mapping and real-time portfolio context.

Enrich portfolio insights by connecting external custodians and alternative data sources, ensuring up-to-date, actionable intelligence for every client conversation.

Experts enable your success

Accelerate time-to-value with a team of experts and an engagement model dedicated to your success

Supplement our training programs with live and in-app support

Client data is holistic and protected

Addepar allows you to view your accounts, or any other asset regardless of asset type or custodian

We’ve designed a multifaceted data security program that ensures the confidentiality, integrity and privacy of the data managed on our platform. Addepar is SOC 3 compliant

Enhance the employee experience

Provide talent with the tools to more easily do their jobs

Use best-of-breed technology to help you recruit and retain top talent

NEWS & INSIGHTS

Catch up on the latest enterprise news from Addepar

J.P. Morgan Private Bank launches new Lifestyle Services Offering

Read more

The world’s top 250 fintech companies: 2025

Read more

HSBC UK Private Banking deploys Addepar platform

Read more

HSBC UK Private Banking partners with Addepar to provide brand-new client reporting experience

Read more

HSBC UK Private Banking partners with fintech to enhance client reporting

Read more

Addepar Acquires AI Workflow Automation Startup Arcus

Read more