Addepar’s cutting-edge technology transforms how institutional investors manage and analyze their portfolios. With Addepar, you’re not just managing assets — you’re transforming possibilities.

Empowering endowments, foundations, sovereign funds and pensions

Addepar’s technology empowers institutional investors like you to track and model any investment type — on one platform — for a more holistic view and dynamic approach to multi-asset portfolios.

Addepar combines secure, cutting-edge technology with the flexibility to handle the complexity of multi-asset exposure, ensuring you make long-term capital decisions that align with your mandate.

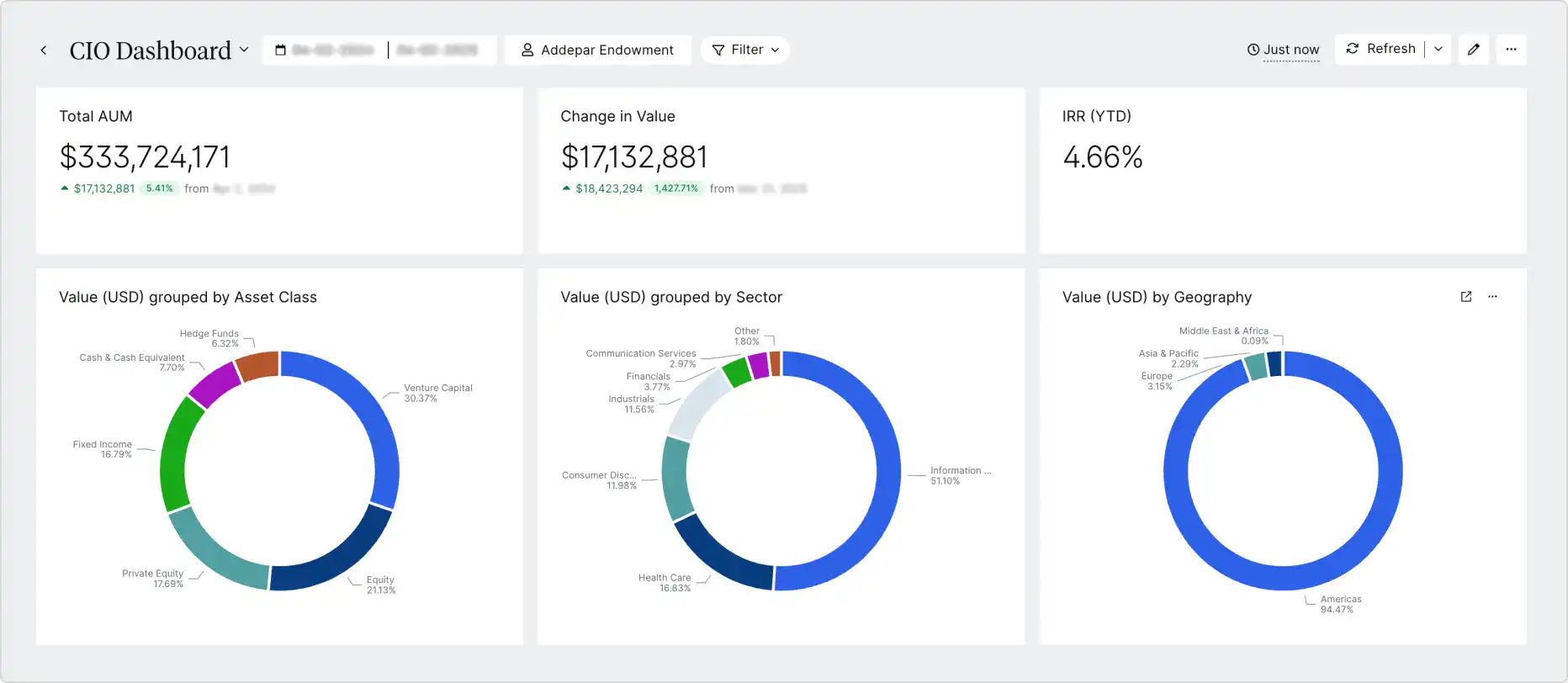

With Addepar, you can build synergies across asset class teams and rely on a single source of truth for holistic reporting to your board or investment committee.

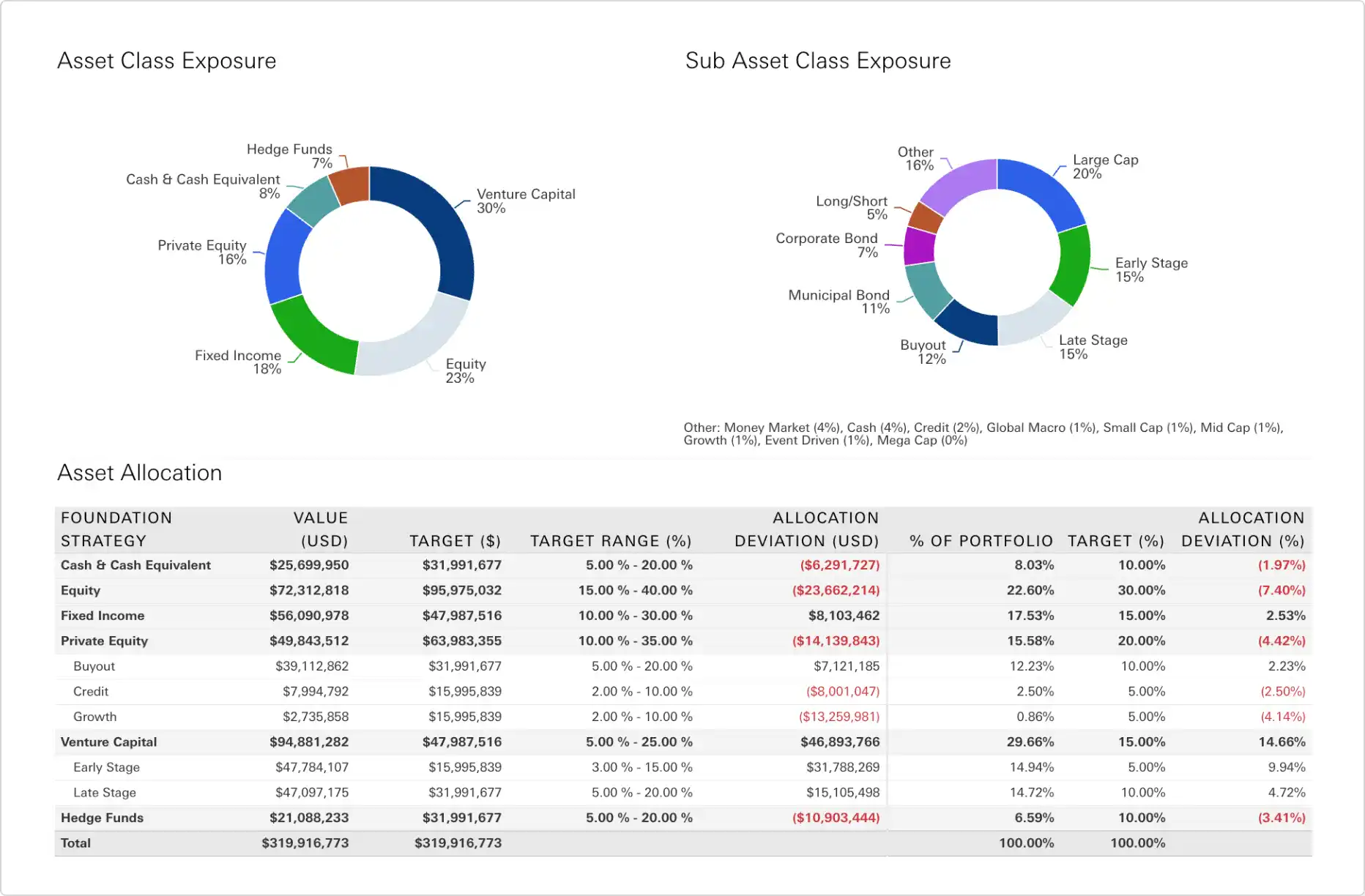

Holistic portfolio analysis: Break down silos with a unified platform that integrates all asset classes.

Risk and performance management: Protect your mission while identifying opportunities for growth.

Collaborative reporting: Equip your investment teams with seamless data access and bespoke reporting you need for digestible data consumption.

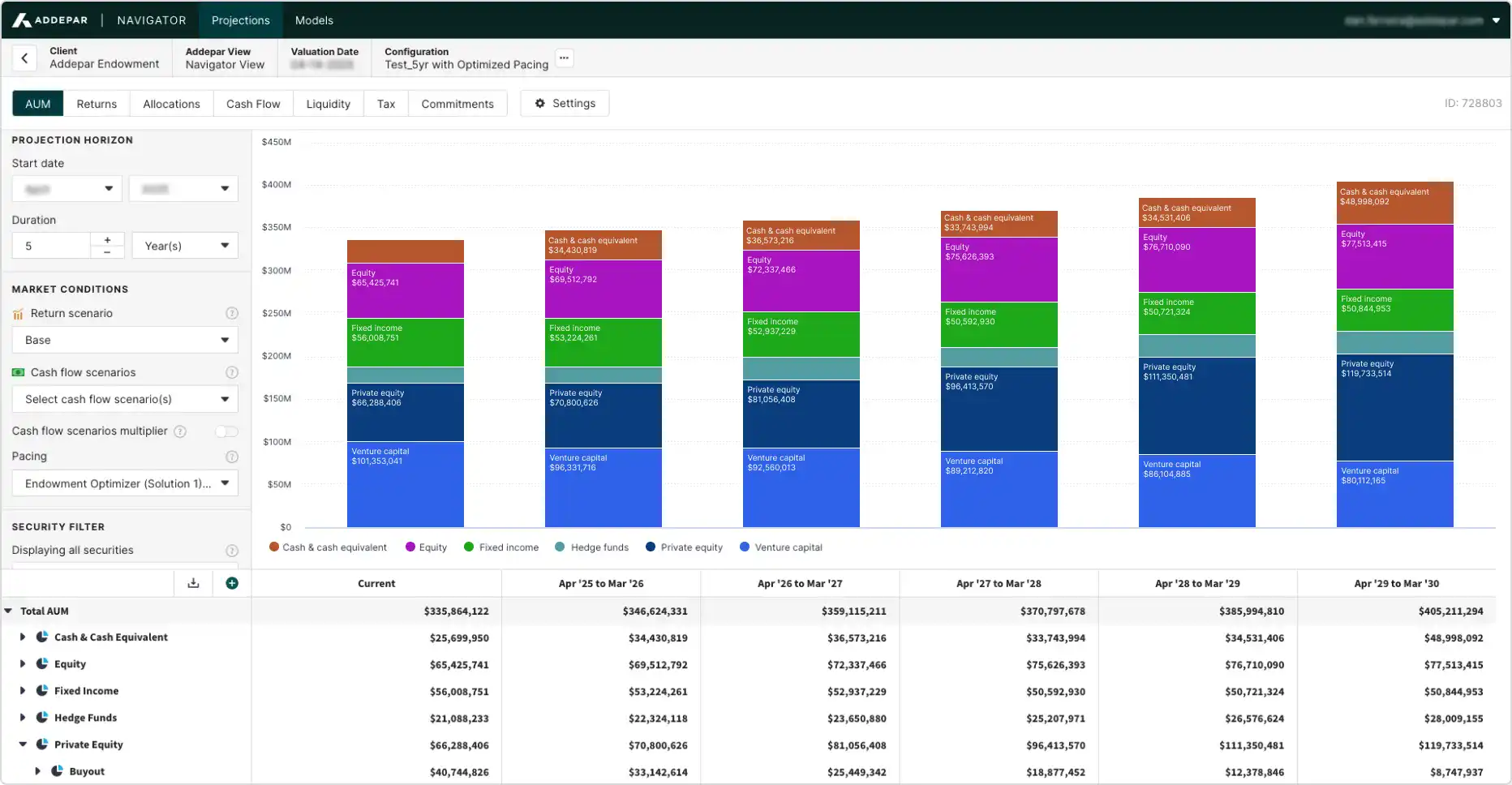

Flexible scenario analytics: Leverage Addepar's projections product, Navigator, to build your own custom cash flow forecasts, scenario analytics, and pacing and liquidity modeling across asset classes.

Automated manager data: Collection and processing of all investment data for your alternatives — eliminating manual tasks, speeding up data aggregation and vastly increasing operational efficiency for your team.