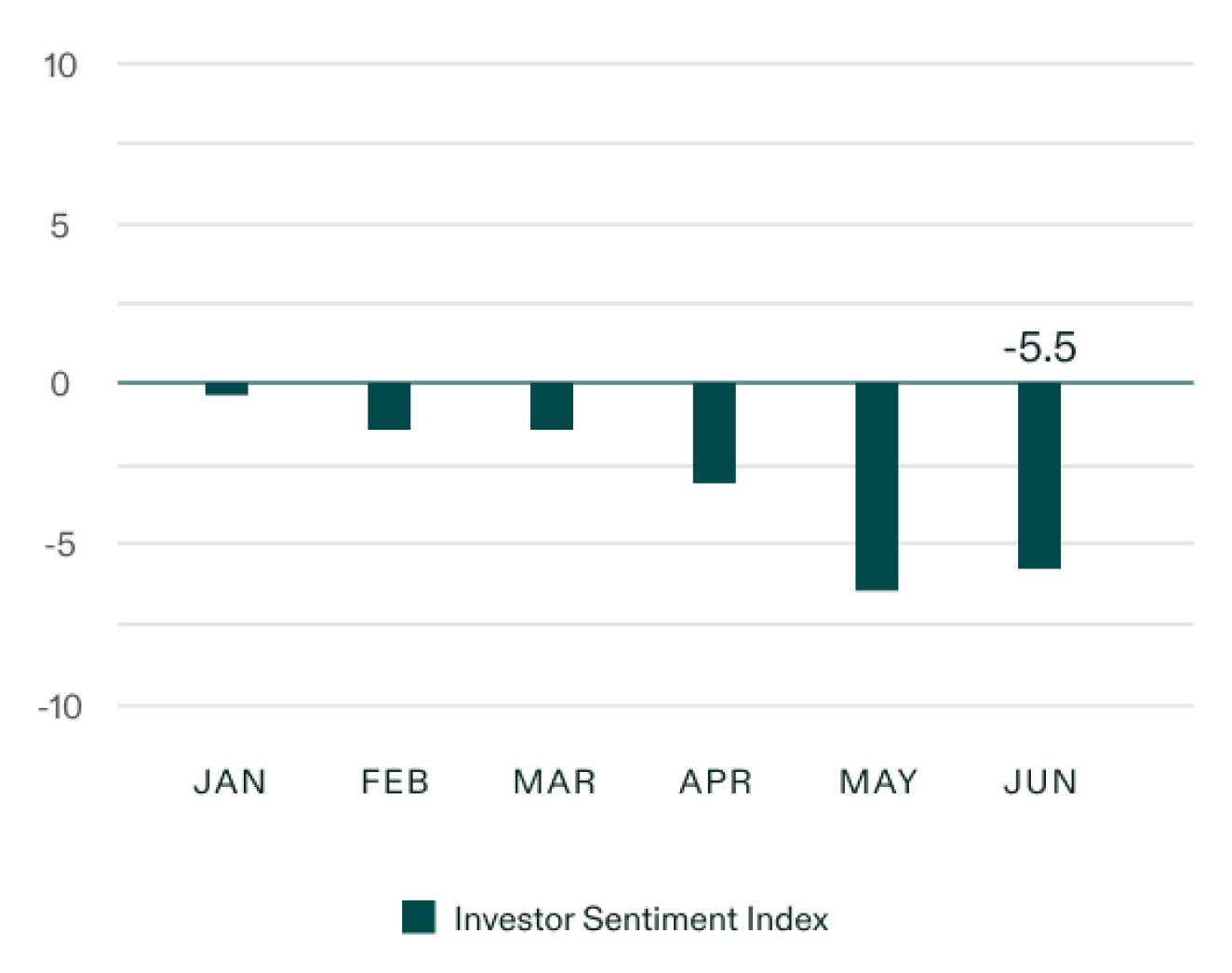

Monthly Investor Sentiment Index

ISI Reading

The index is calculated as the relative share of individual investors that are net buyers of U.S. equity securities versus those that are net sellers or net neutral in a monthly time frame producing a reading between -100 and 100.

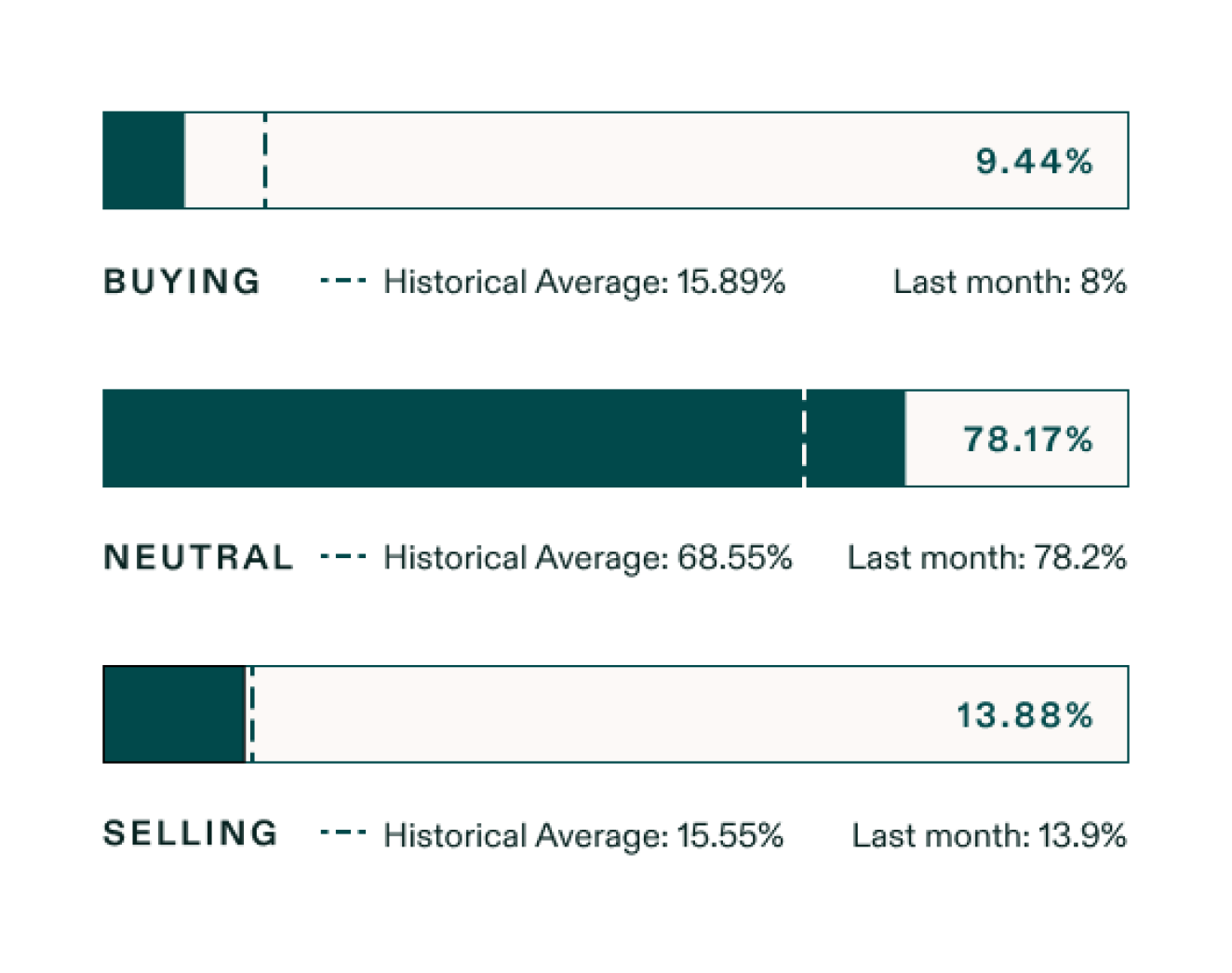

ISI Activity

The activity represents the index components such that “buying” - “selling” will net to the ISI. Dotted lines represent the historical average for each component.