You already have the power of Addepar. Take it one step further with Addepar Navigator, our portfolio projection tool that allows you to simulate scenarios and forecast cash flows for your clients’ complex private market investments.

Three Bridge looks forward with clarity

“It’s helped better guide on a go-forward basis and it’s been instrumental. It’s really the foundation of our client discussions.”

- Eric Thurber, Co-founder, Three Bridge Wealth Advisors

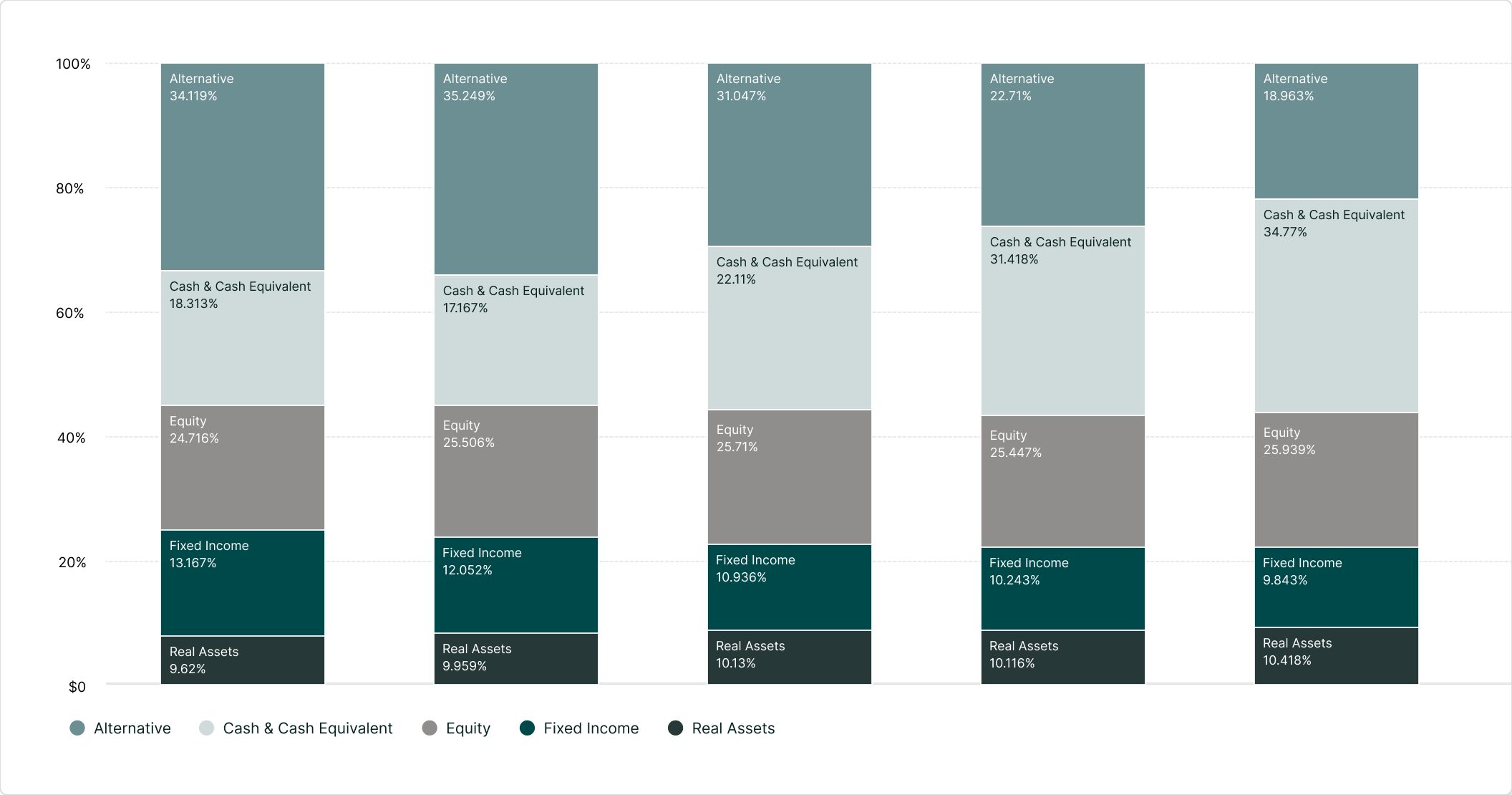

Project and optimize cash flows

Commitment-based funds create liquidity risk often mitigated by holding too much cash that can cause a drag on returns. Navigator helps you optimize cash management by modeling and projecting portfolio spending, commitments and distributions.

Leveraging Addepar and Navigator to forecast portfolio risks and returns

Learn more about Addepar + Navigator

If you are an Addepar client and would like to speak with a team member about Navigator or arrange a demonstration, please complete this form.

If you are not a client and would like to learn more, click here.

Thank you for your interest in learning more about Addepar Navigator. Your account management team will contact you shortly.