Published on

Drive tax efficiency and growth with householding in Addepar Trading

Successful advisors help clients reach their financial goals while creating opportunities for business growth for themselves, and their firms. Addepar Trading’s householding solution streamlines portfolio management, enabling advisors to seamlessly aggregate multiple client accounts under a unified investment strategy. With this solution, advisors can optimize projected after-tax performance, meet diverse financial targets efficiently and demonstrate value that opens the door to business expansion.

What can you do with householding?

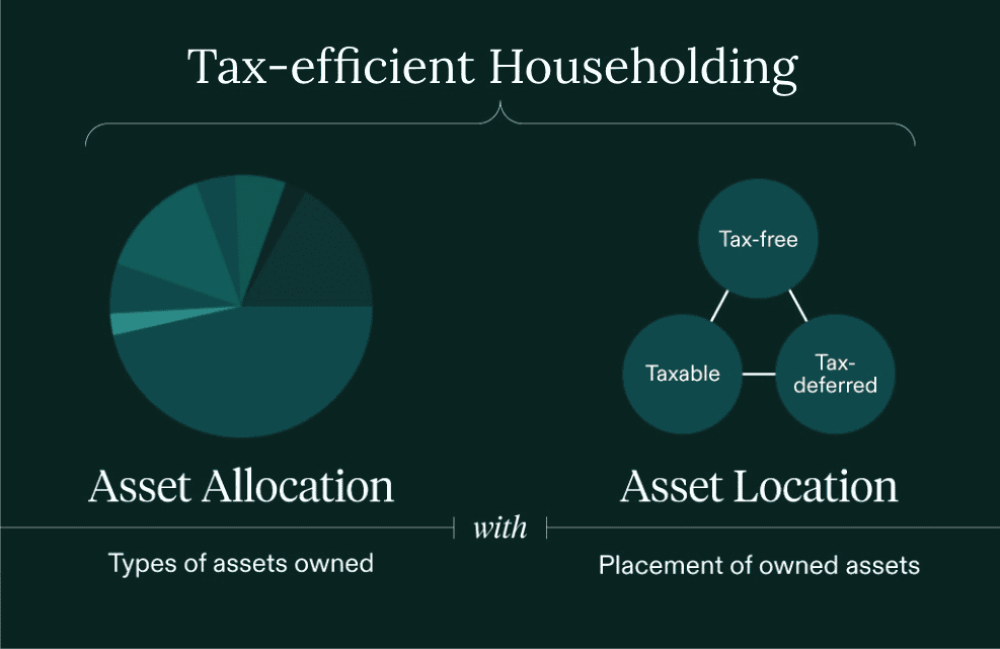

Householding lets advisors combine multiple accounts into a single portfolio — a household — and manage them under one overarching asset allocation strategy. This mirrors the common industry practice of creating households to address different financial objectives, such as retirement, education or major purchases.

For instance, a client saving for retirement might use an IRA, a Roth IRA and an investment account, each with distinct tax characteristics. Addepar Trading allows advisors to unify these accounts under a single investment strategy based on the client’s life stage, risk tolerance and financial goals.

Enhancing tax efficiency with LifeYield®

Addepar Trading has partnered with LifeYield® to integrate its proprietary asset location engine — and enhance tax efficiency. This powerful algorithm optimizes projected after-tax returns by strategically locating trades within the appropriate accounts based on their taxability and the tax consequences of various asset types.

For example, assets with higher income tax implications can be placed in tax-deferred accounts, while tax-efficient investments may remain in taxable accounts. This approach maximizes household-level projected after-tax returns and ensures the portfolio aligns with the client’s broader financial goals.

Increase your value and your business

Householding offers more than just investment efficiency — it provides an opportunity for advisors to demonstrate the success of their investment strategy and the value they bring, potentially helping to cultivate growth for their business.

Many advisors only oversee a subset of their clients’ wealth. By managing a household portfolio with a unified strategy and optimized tax efficiency, advisors can demonstrate significant projected after-tax savings and overall value, showcasing the benefits clients stand to gain by consolidating more assets under their management.

The Bottom Line

Addepar Trading’s householding capability provides advisors with the tools they need to:

Easily manage diverse financial goals: Aggregate accounts under a unified strategy tailored to client objectives.

Maximize projected after-tax returns: Leverage LifeYield’s proprietary technology to pinpoint tax-efficient locations for all assets.

Drive business growth: Showcase the benefits of consolidating client assets with one advisor and expanding their portfolio oversight.

With householding, advisors can deliver greater value to clients while growing their assets under management.

Explore how Addepar Trading can transform your portfolio management strategy. Connect with us to learn more.