Streamline Complexity

Addepar Trading is your end-to-end solution for trading and rebalancing, designed to deepen your portfolio management capabilities.

Streamlined trading and rebalancing

Scalable for growing firms

Leveraging unified data from Addepar

Deeper Functionality

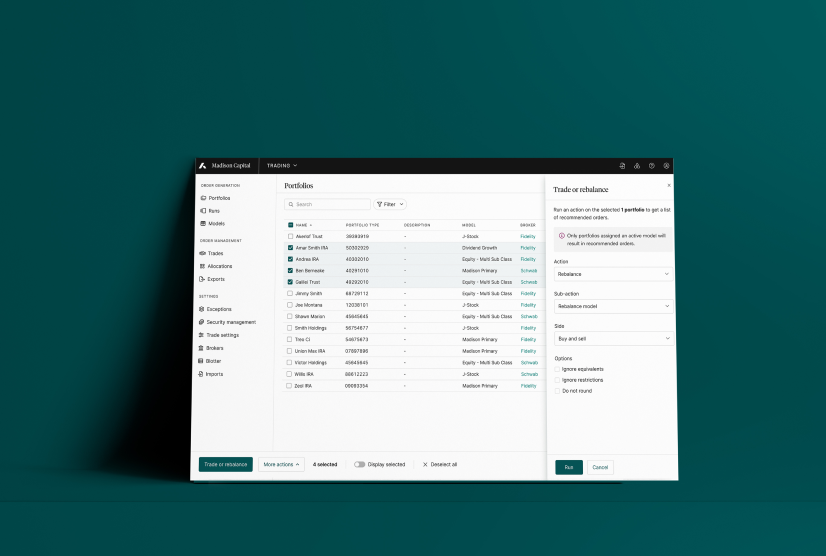

Harness robust tools for every portfolio need

Rebalance at the asset class and sub-model levels

Raise cash, invest funds and rebalance portfolios in bulk

Manage and rebalance investments across entire households

Access intraday pricing

Get a comprehensive, interactive display of portfolio holdings with portfolio worksheets

Implement firm-wide and client-specific pre-trade compliance checks

Confirm trades are within specified limits with order validations

Make timely portfolio decisions that consider the impact of in-flight trades yet to be executed or settled

Create security models, models of models and construct complex tiered structures

Transition portfolios to new models using equivalent lists

Implement and manage client-based restrictions and preferences

Perform cash simulations to see the impact of different scenarios

Export trade data in standardized flat-file formats

Assign routing rules to specific brokers

Utilize automated trade communication via FIX (add-on)

Leverage post-trade processing and messaging

Minimize reliance on late custody data with our Investment Book of Record (IBOR)

Resources

Access more information about Trading

Frequently asked questions

Having Addepar data directly embedded within Addepar Trading enables our clients to identify areas needing attention quickly. By integrating data seamlessly, clients are guided to portfolios requiring action with confidence in the accuracy and timeliness of the information displayed. This efficiency reduces time spent navigating the platform, allowing advisors to prioritize time spent with their clients.

Addepar Trading supports multi-account rebalancing, allowing users to create a single block and execute trades across multiple accounts efficiently.

Addepar Trading includes all portfolio holdings in valuations, even if an asset lacks a ticker or isn’t actively traded. These assets are accounted for in portfolio balances and allocations unless you exclude them. This flexibility lets you decide whether to include private investments in your models and rebalancing.

Addepar acquired AdvisorPeak as part of our commitment to providing a best-in-class trading experience. Through our work with AdvisorPeak, we gained deep insights into the needs and challenges of our clients, which has guided us in developing Addepar Trading—a more robust, fully integrated solution.

Find out more

Thank you!

We have received your request

We will reach out to you shortly.