Published on

Inside Addepar is a quarterly round-up of Addepar platform updates, research insights and client, partner and company news.

In our Q2 edition, we're showcasing the latest advancements designed to empower your firm. This quarter, we've rolled out the all-new Portal Views, drift monitoring in Addepar Trading, and capital gains tax modeling across all model types in Navigator. We’re unveiling new integrations with Bipsync and Fynancial, and sharing insights from clients Laird Norton Wetherby, Stone Temple Partners and Bird&Bee. We’re also celebrating some exciting company milestones — namely our $230 million Series G funding, the strategic acquisition of Arcus, our partnership with HSBC UK Private Banking, and the success of AddeConf25. Check out the latest below.

Product Updates

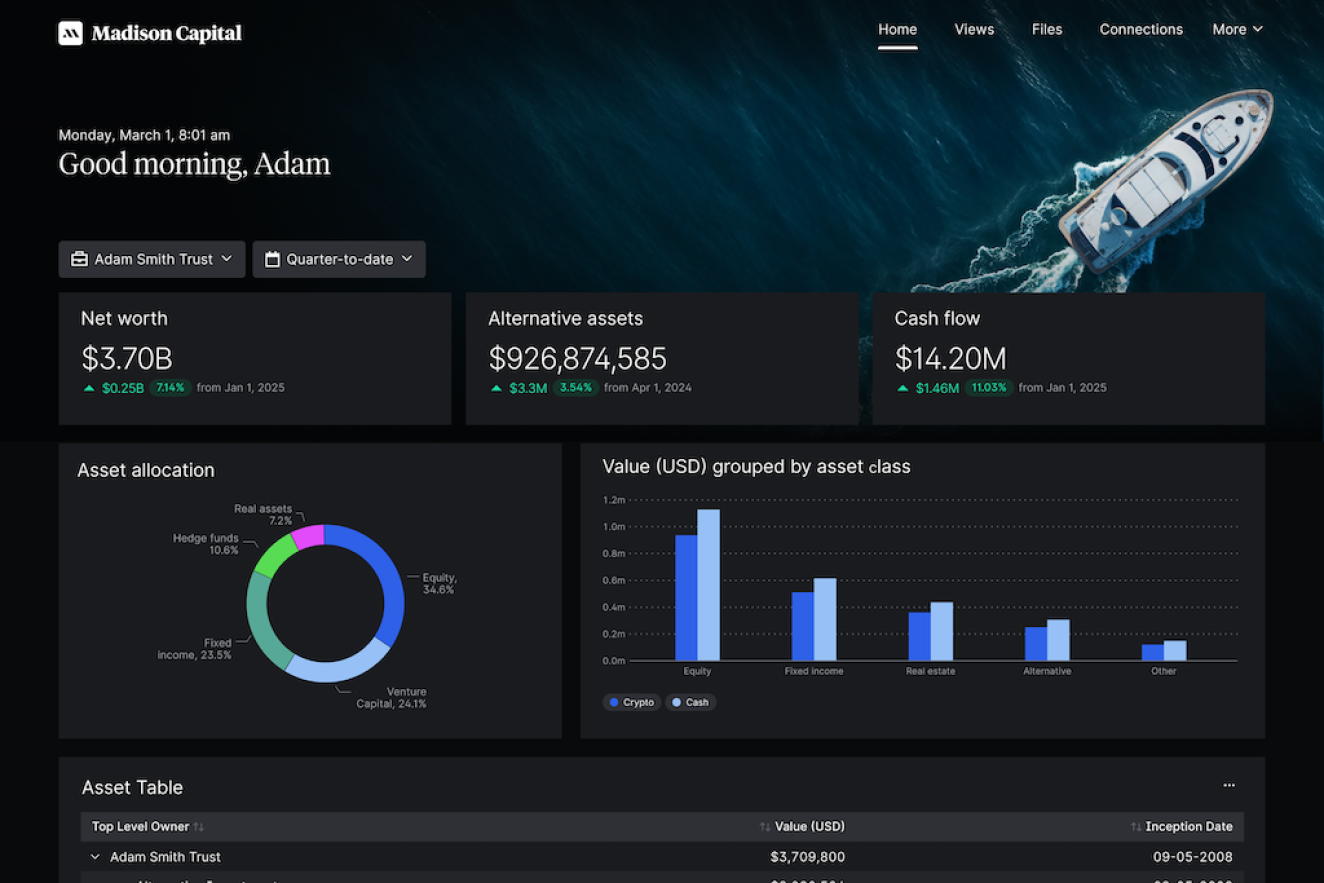

Showcase your firm with a modern look and feel

Highlight your brand with a background image and custom color palette in the new Portal Views. Choose from four built-in background themes or upload your own image.

Visual Signature in the Client Portal

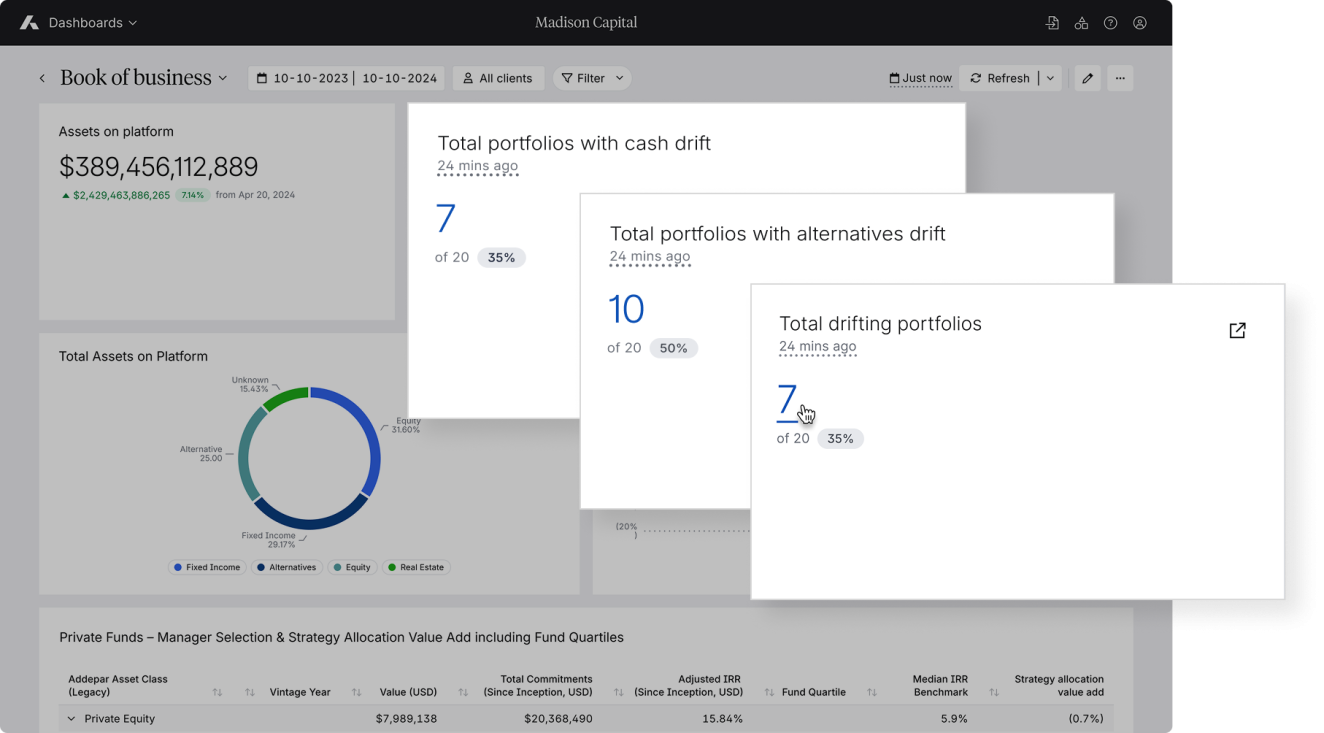

Streamline oversight and act faster with drift monitoring in Addepar Trading

Surface portfolios drifting from their assigned models directly in Dashboards with the new drift monitoring widget for Addepar Trading. Define drift thresholds, filter by entity or asset class, and take immediate action by navigating to a pre-filtered portfolio list with full context.

See which portfolios are out of alignment directly from Dashboards

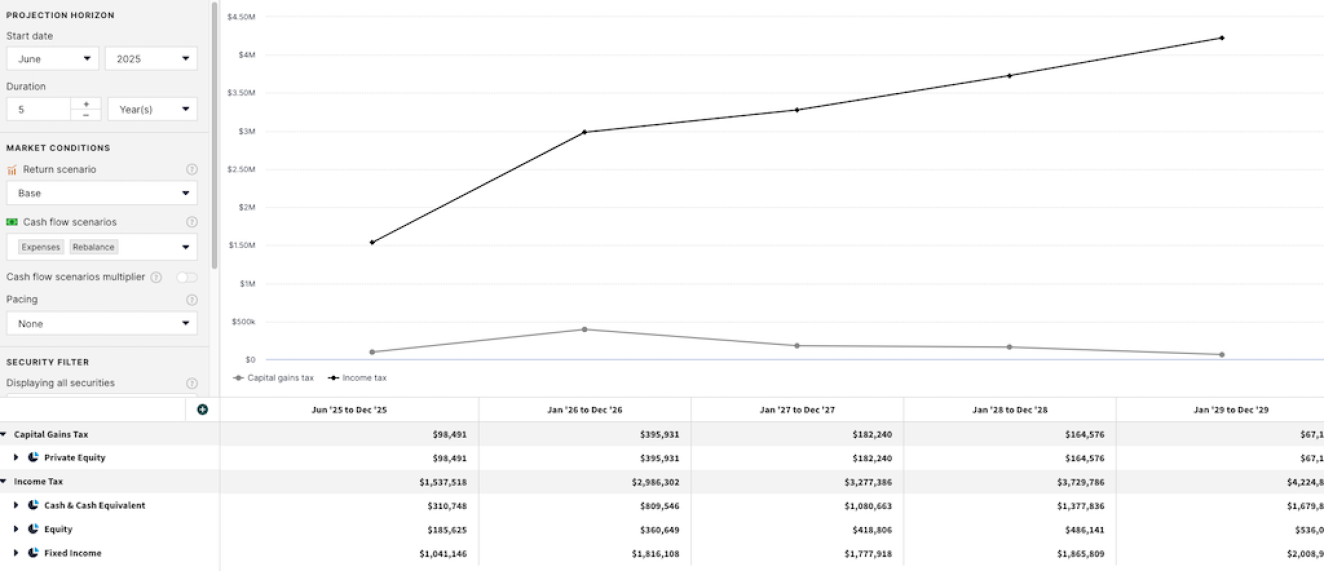

Capital gains tax modeling now supported across all model types in Navigator

With the latest enhancement to the private equity model, Navigator now enables capital gains tax modeling across your entire portfolio. This means you can simulate exits, apply a capital gains rate and forecast after-tax cash flows that are more realistic — even for illiquid investments.

Compare income and capital gains taxes over time, by asset class

Addepar clients can review the release notes for details on our latest product updates. Not a client? Contact our team at bd@addepar.com for more information.

What’s happening around the Addepar community

Ecosystem update

We’re excited to announce new integrations with Bipsync and Fynancial. Read below or visit our Integration Center to learn more. When there, you can easily filter by “New” to discover the latest or sort by “Region Served” to find partners operating in your region.

Bipsync - Connect Addepar’s portfolio data with your investment research and due diligence workflows in Bipsync’s purpose-built research management software.

Fynancial- Seamlessly integrate Addepar’s portfolio insights using powerful client engagement tools via your firm’s own branded app — provided by Fynancial. By meeting clients on their phones, RIAs can deliver personalized experiences, strengthen relationships, and drive growth.

Perspectives from our clients

Laird Norton Wetherby: How did Laird Norton Wetherby successfully merge the systems across three firms with minimal operational disruption? They brought everything together on Addepar. Since implementing Addepar, the firm has experienced improved reporting and alternatives management processes.

Stone Temple Partners: Stone Temple previously managed multi-million dollar drawdowns and 10-year pacing plans using fragmented spreadsheets — manually updating capital call forecasts, scenarios and reconciliations. With Addepar Navigator, they transformed their planning and execution infrastructure, replacing manual workflows with a centralized, continuously updated platform that enables forward-looking analysis and consistent decision-making.

Bird&Bee: A one-person advisory firm serving high-net-worth families doesn’t have time to waste on bad tools or insufficient solutions. That’s why Tanja Michiels, founder of Belgian firm Bird&Bee, chose Addepar. Read on to see how she eliminated the risk of error from manual data entry while reducing time spent inputting transactions to only minutes a day.

Hear from Addepar experts

Meet Jamie Signorile, Head of Global Enterprise Solutions Engineering here at Addepar. His teams form the metaphorical “tip of the spear,” bringing global banks and institutional investors the foundational infrastructure and tools they need to harness the true power of their data.

Tune in to our webinars

Register to join us on July 15th at 10 am PT / 1 pm ET to learn about Addepar's partnership with YCharts, enabling advisors to tell their client's portfolio story through dynamic charts, scatter plots, tables and more.

Catch recent on-demand webinars, which discuss gaining efficiencies with portfolio onboarding, the $65 trillion alternatives opportunity and a deep dive into Dashboards.

Addepar in-person

Addepar proudly returned to BNY Pershing's INSITE as a sponsor, joining thousands of financial professionals to discuss the future of advice and technology. Our booth was a hub for high-impact conversations on AI in wealth management, personalization at scale, the growing role of alternatives in portfolio construction and building lasting client trust through data.

We also connected with advisors at Wealth Management EDGE, where our live demos brought Addepar's capabilities to life, showcasing real-time data visualizations and integrations that advisors can rely on.

The Addepar team at BNY Pershing's INSITE

Company Updates

Addepar raised $230 million in Series G funding at a $3.25 billion valuation, co-led by Vitruvian Partners and WestCap, with support from 8VC, Valor and new investor EDBI. This milestone further fuels our innovation and global expansion.

Addepar announced the strategic acquisition of Arcus, a leader in enterprise AI workflows, to accelerate our long-term vision to more deeply integrate sophisticated AI and machine learning into our platform.

Addepar has partnered with HSBC UK Private Banking — our first major UK bank client — to deliver powerful data aggregation and performance reporting capabilities. This collaboration expands on our work with HSBC US and marks a significant step in supporting premier global institutions with advanced portfolio intelligence.

AddeConf25 brought together clients, partners and industry experts in New York for a day of discussion, discovery and connection. From thought-provoking panels to hands-on product sessions, we explored the trends shaping our industry and shared ideas to drive innovation forward. We’re grateful to everyone who joined us and are energized by the momentum as we look to the future.

About Addepar

Addepar is a global technology and data company that helps investment professionals provide the most informed, precise guidance for their clients. Hundreds of thousands of users have entrusted Addepar to empower smarter investment decisions and better advice over the last decade. With client presence in more than 45 countries, Addepar's platform aggregates portfolio, market and client data for over $7 trillion in assets. Addepar's open platform integrates with more than 100 software, data and services partners to deliver a complete solution for a wide range of firms and use cases. Addepar embraces a global flexible workforce model with offices in Silicon Valley, New York City, Salt Lake City, Chicago, London, Edinburgh, Pune and Dubai.