Tim Hall, a trusted advisor with 25+ years of global investment experience, Alex Herman, a multi-asset class portfolio manager with 16+ years of experience, and David Ward, an expert in operational infrastructure with over 30 years in the field, are the co-founders of Stone Temple Partners. From the beginning, they asked a bold question: What would the best $20 billion family office in the world do? Then they set out to build it — not for one ultra-wealthy household, but for multiple families on a shared platform. These sophisticated clients all have meaningful assets, complex needs and a desire for more than a traditional 60/40 portfolio. They didn’t only want advice; they wanted an engine, a system and a clear strategy.

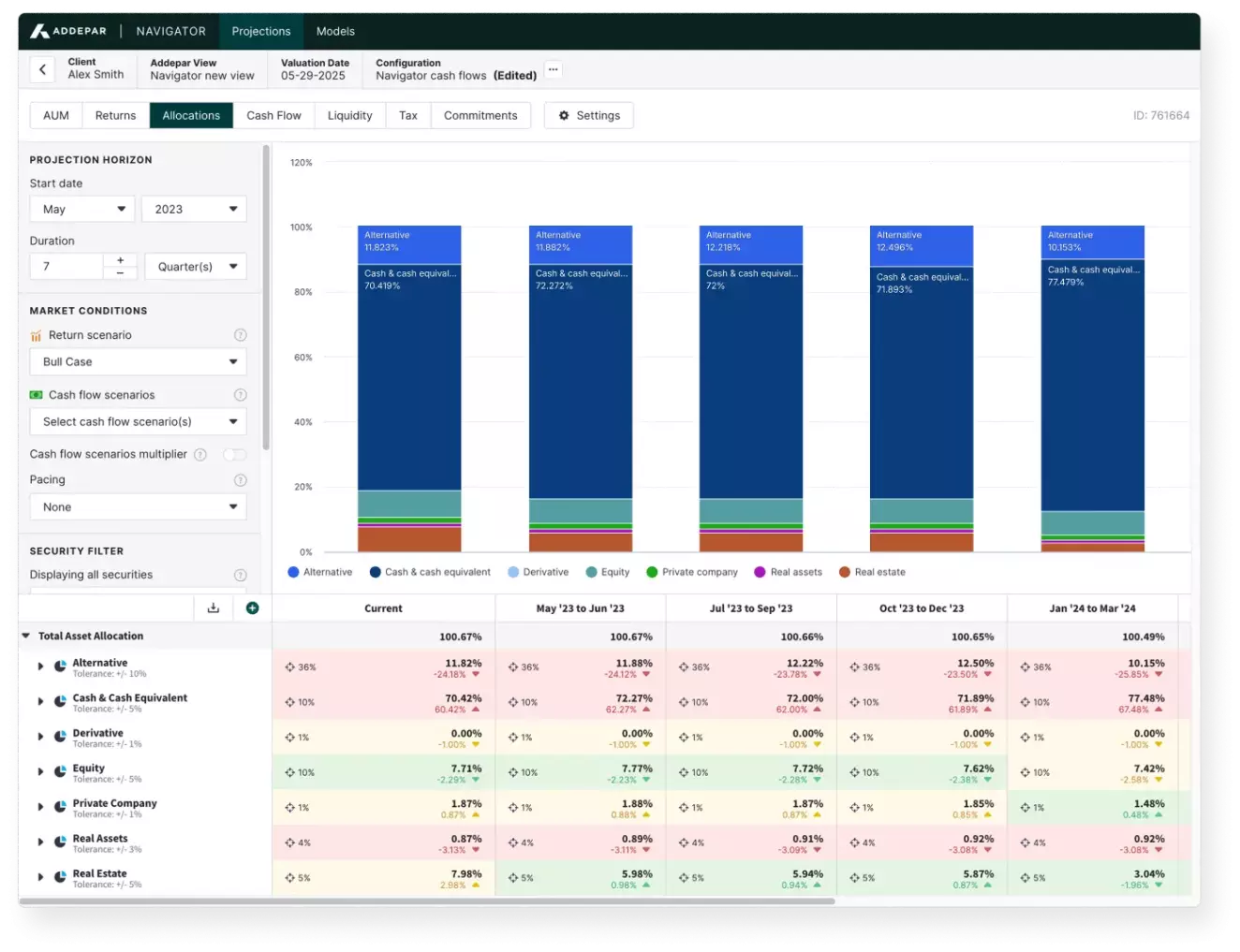

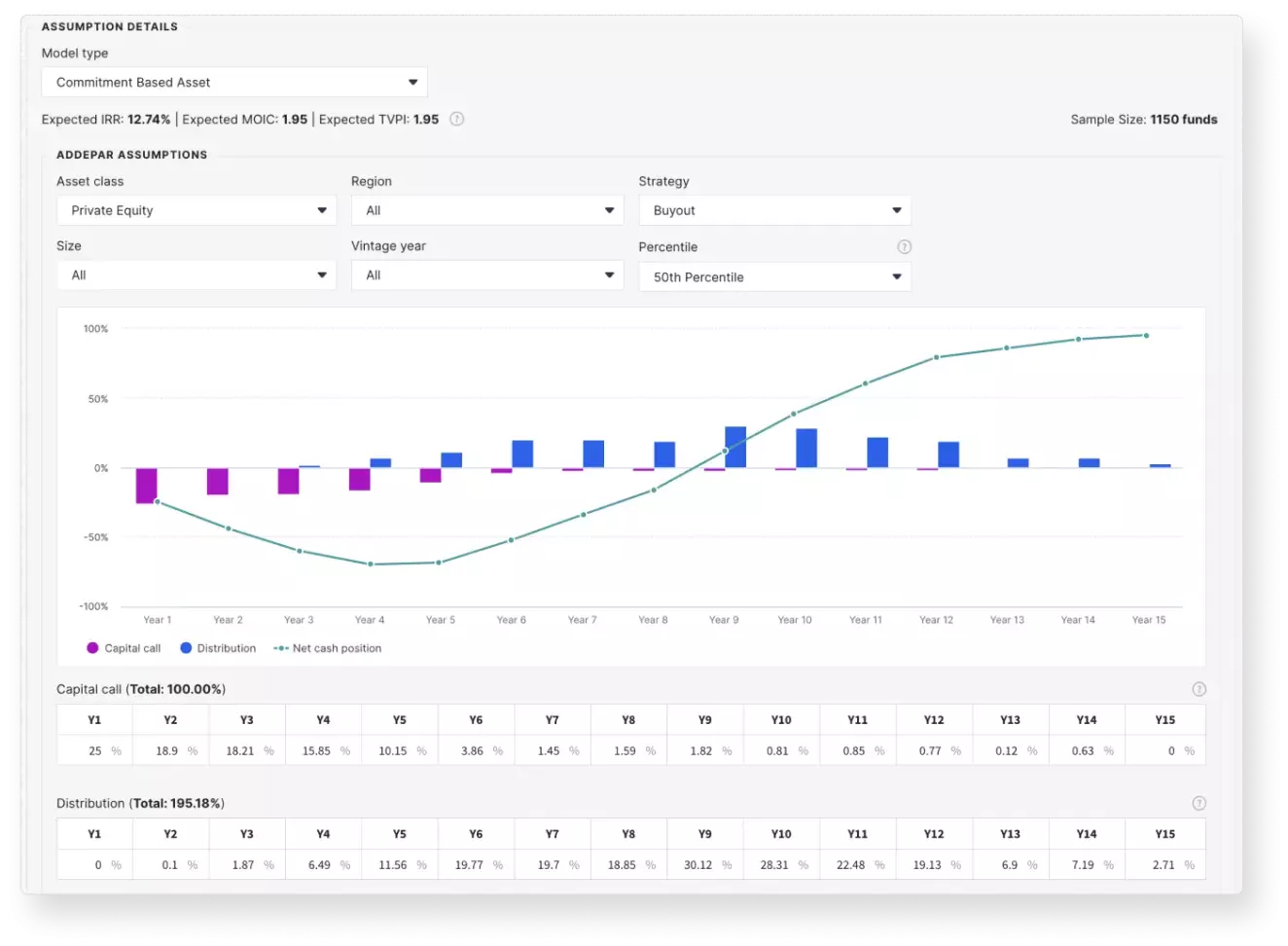

Stone Temple understood their clients’ needs and carefully built their investment and wealth advisory platform around high-caliber investment professionals, deep relationships with best-in-class managers and strategically constructed portfolios with over a 50% allocation to private market investments. Even so, this strong foundation was not enough. Running unique portfolios for multiple families, each with legacy positions, custom preferences and different timelines, Stone Temple quickly encountered significant bottlenecks and limitations in managing their clients’ assets using Excel spreadsheets.