Published on

It’s easy to feel confident in bull markets. The real test of an investment strategy, especially at the institutional level, is how well it holds up when conditions shift.

For CIOs, investment committees and multi-asset allocators, the stakes are high. The portfolios they oversee often support long-term obligations — scholarships, retirement benefits, grantmaking or operational expenses — that don’t pause during market downturns. The question isn’t “what are we investing in?” but “are we prepared for what could happen next?” As such, scenario analysis is not just helpful, it’s essential.

From static forecasts to dynamic prep

Traditional forecasting methods tend to assume linear growth and stable inputs. In reality, markets are rarely that cooperative. Geopolitical shocks, delayed distributions from private investments, rising interest rates and shifting liquidity needs can expose gaps in even the most well-crafted strategy. Institutions that rely on static models may not see these pressure points until it’s too late.

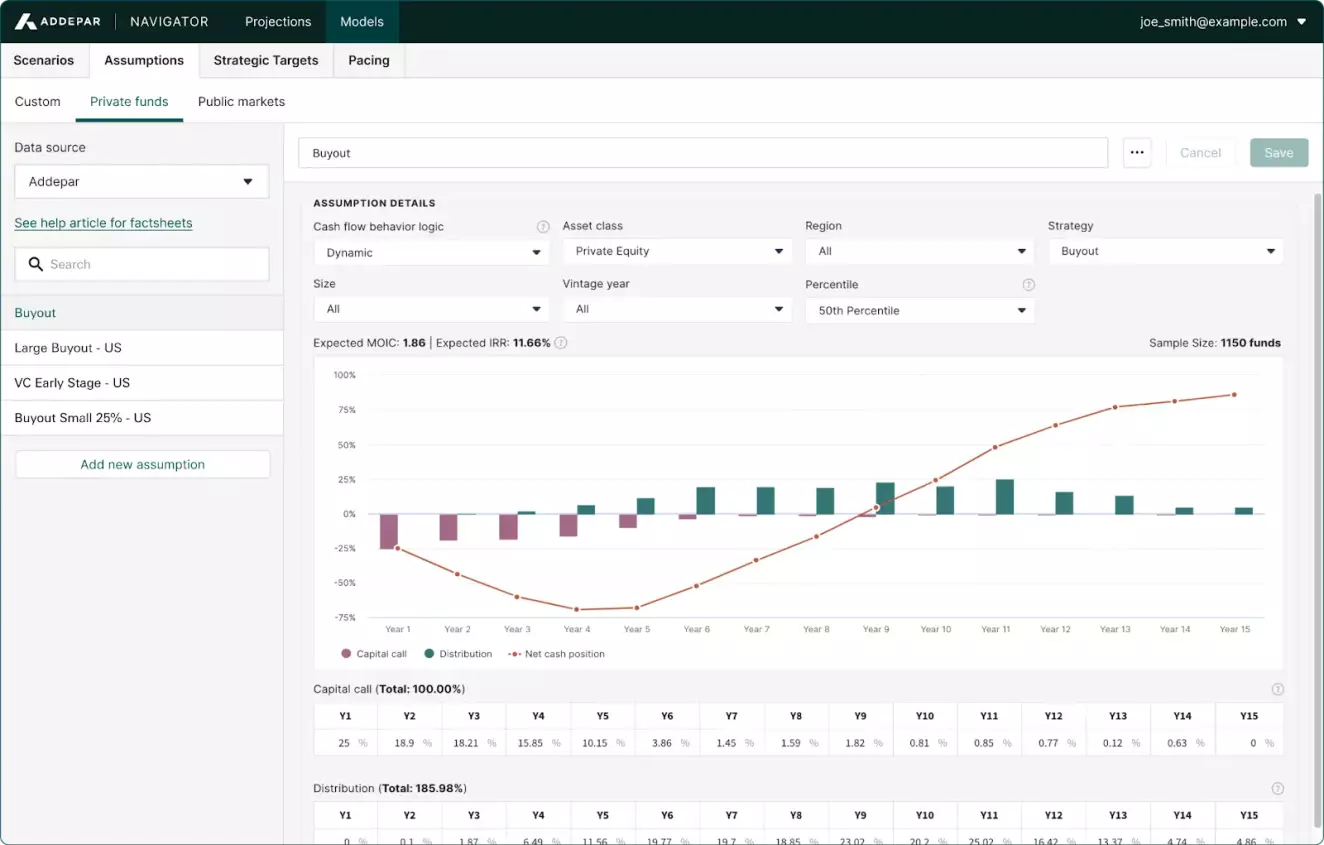

Instead, institutions need a way to simulate a wide range of scenarios — from prolonged equity downturns to unexpected windfalls in private markets — and to evaluate the ripple effects across their entire portfolio. With Addepar Navigator, institutions can leverage dynamic forecasting and scenario analysis to anticipate risk, optimize decisions and navigate uncertain markets with confidence. It’s not about predicting the future; it’s about preparing for several versions of it.

Strategic questions institutions are asking

From liquidity crunches to shifts in private market pacing, institutional clients are using Navigator to actively model the scenarios that matter most to their long-term strategy. These models aren't theoretical but practical tools for making informed, confident decisions amid uncertainty. Some of the questions they’re tackling include:

What if public markets drop 15% over the next year? How does that affect our liquidity and commitments?

If our top-performing private equity fund delays distributions by a year, can we still fund next year’s operating expenses?

What happens if we reduce our cash reserves to pursue higher-return alternatives?

How do different rebalancing strategies play out under bullish vs. bearish conditions?

By adjusting assumptions around capital calls, distributions, valuation changes and inflows/outflows, institutional teams are gaining deeper insight into their portfolio’s performance and resilience.

Utilize the Addepar private fund cash flow forecasts to anticipate capital calls, plan distributions, and manage net cash position across vintages.

Reactive to proactive decision-making

One of our institutional OCIO clients runs quarterly bull, base and bear scenarios with Navigator. They model everything from macro market shifts to idiosyncratic risks in their alternatives exposure. As a result, they can walk into every investment committee meeting with data-backed conviction in their strategy.

This kind of forward-looking modeling helps CIOs and finance teams:

Align with stakeholders on risk tolerance and time horizons

Preemptively identify liquidity bottlenecks

Confidently adjust allocations in response to changing conditions

Make long-term commitments without overextending short-term capacity

Planning is the new alpha

Markets may surprise us, but one thing is certain — institutions that build flexibility into their planning are better positioned to stay the course and seize opportunities while others are scrambling to react.

With Navigator, scenario analysis serves as not only a necessary stress exercise, but a strategic tool. It equips institutions to test ideas, pressure-test assumptions and prepare for both the worst and the best outcomes, all starting with the right questions.