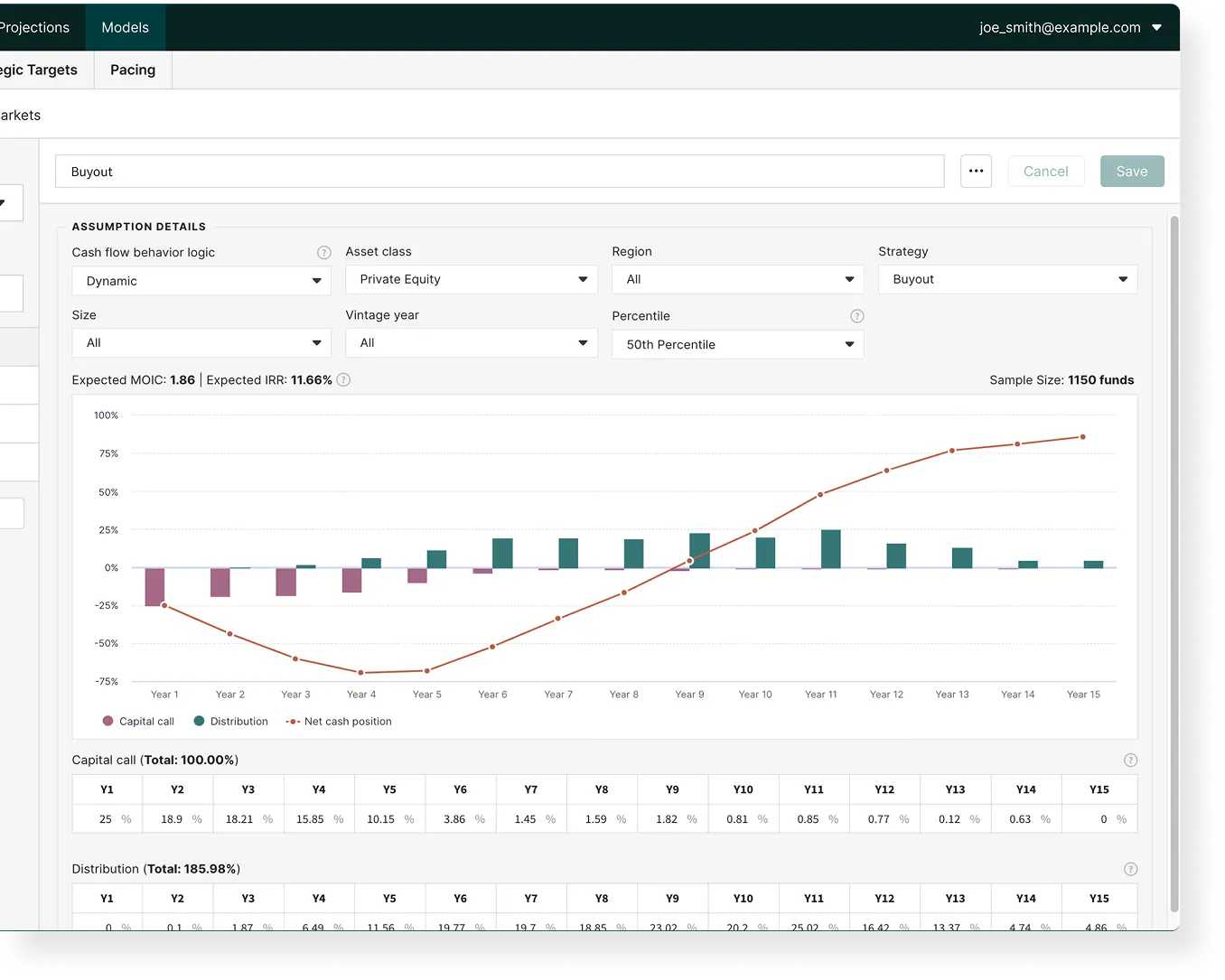

Consolidate cash inflows and outflows across all asset classes. Model dynamically with real-time data, custom assumptions and historical trends, with Navigator.

Download

Forecast the future — from cash flows to liquidity

Whether you’re managing a $500M book of business or a multibillion-dollar portfolio, forecasting liquidity quickly and accurately has never been more critical. Learn how leading firms use Addepar Navigator to reduce cash drag, plan liquidity and deploy capital with confidence, even in volatile markets.

Download the report

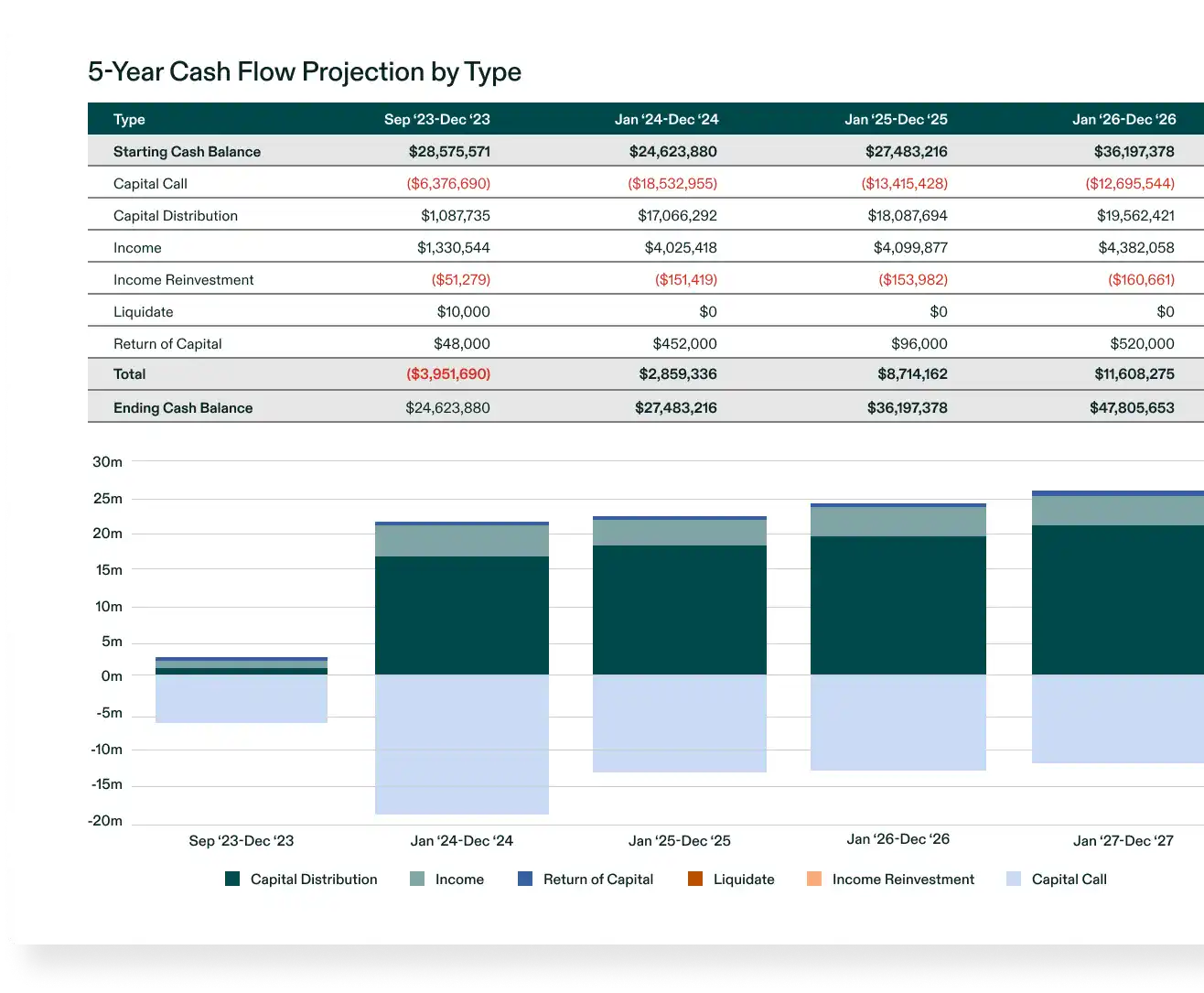

Portfolio-wide cash flow summaries

Structured cash flow reporting

Reduce cash drag by aligning reserve levels with real liquidity needs. Plus, benefit from integrated, structured forecasting and dynamic reporting — all within the Addepar platform. Minimize major risk and say goodbye to manual spreadsheet consolidation.

Before, I felt like I had one hand tied behind my back. That's what prompted adopting Navigator: the ability to have all that data from different funds and know this is actually real data. I can’t imagine if we didn't have Navigator — our commitment sizes wouldn’t have been optimal.

Manuel Jose Rodriguez

Co-CIO and COO, Papo Group

Plan liquidity smarter with Navigator

Discover how you can gain a competitive edge with proactive liquidity planning