View complex client portfolios holistically – even held away, private and real assets – to make smarter investment decisions and generate superior outcomes.

Tools you need to decision and execute

Addepar is an open architecture, multi-product tech and data platform that delivers wealth managers rich data aggregation with maximum flexibility and scalability so that you can do what you do best — even better.

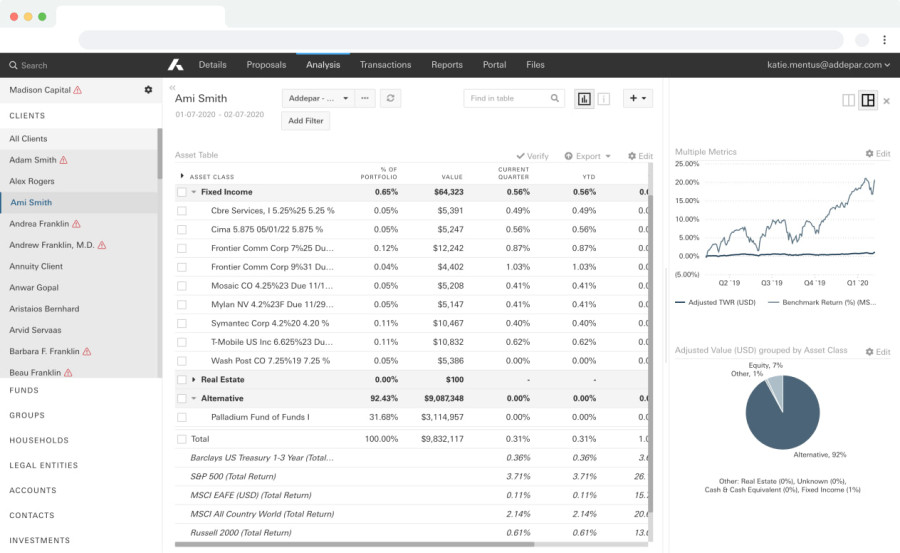

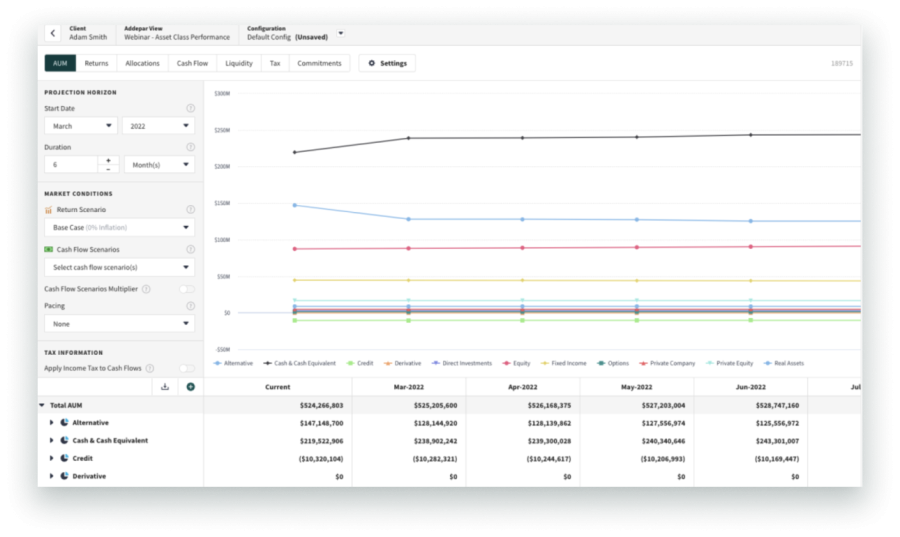

Addepar aggregates all financial accounts to create a consolidated view of your clients’ portfolios.

No matter the type of asset class, currency or entity, data is continually updated and available for all clients

Easily view investments across custodial accounts and uncover opportunities to provide data driven financial plans and holistic advice

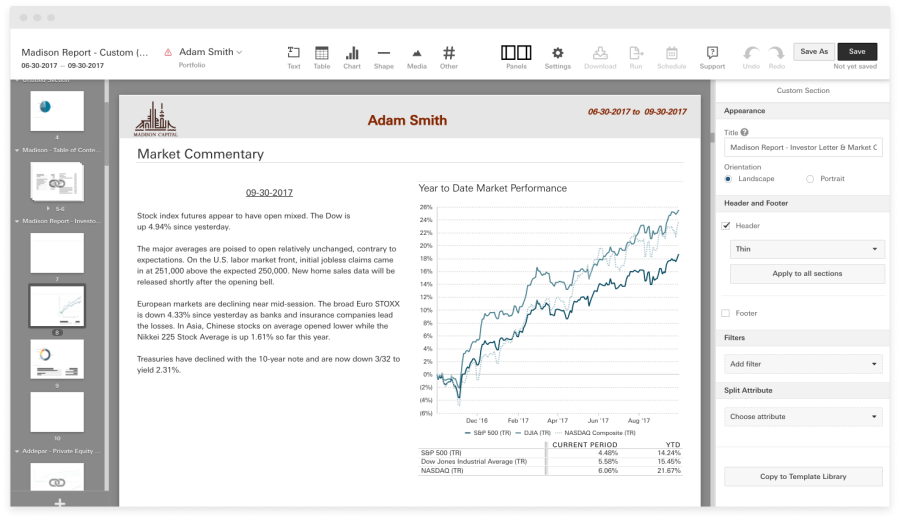

Industry-leading analytics and performance reporting software allow you to tailor insights and conversations for each client and build long-lasting, trusted relationships.

Instantly analyze and visualize portfolio data, and communicate relevant insights to your clients on the fly

Easily create customized, branded reports in minutes

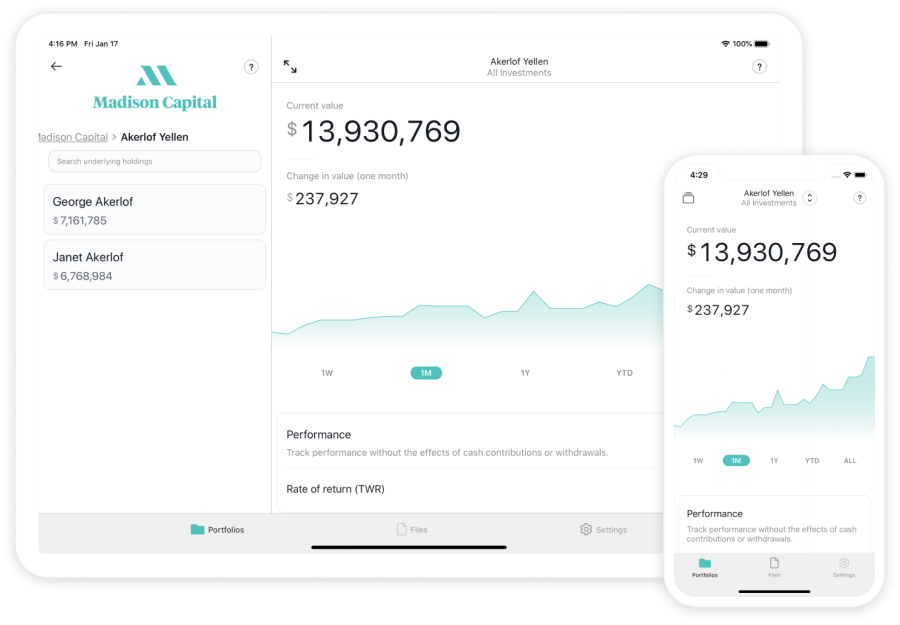

Our digital tools provide your clients with encrypted access to their financial information anytime and anywhere.

A customizable portal provides on-demand access in a highly intuitive experience

Intuitive mobile and iPad apps make it easy for clients to securely access portfolios at any time

Bridge back-office solutions with our custom reporting functionality.

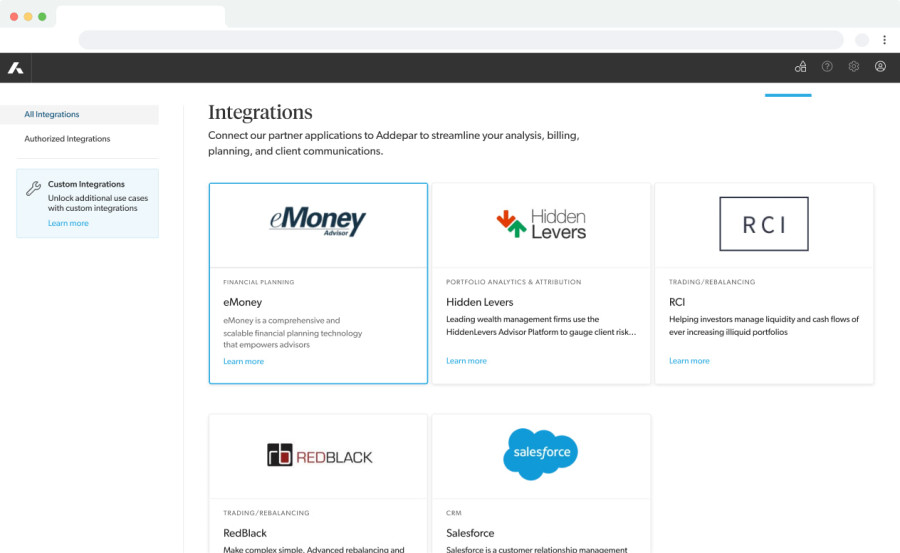

Seamlessly integrate workflows with out-of-the box integrations

Our automated data aggregation and verification allows your team to win back hours spent on manual efforts ranging from reporting to compliance

Integrated Solutions that Enhance Workflows

Align portfolios to targets with portfolio decisions powered by aggregated Addepar data.

Rebalance on demand for select accounts, households, portfolios or an entire book of business.

Model asset allocations–including illiquid assets–to optimally achieve your client’s goals, objectives and cash flow requirements.

Choose from various capital market assumptions to test hypothetical performance across different scenarios.

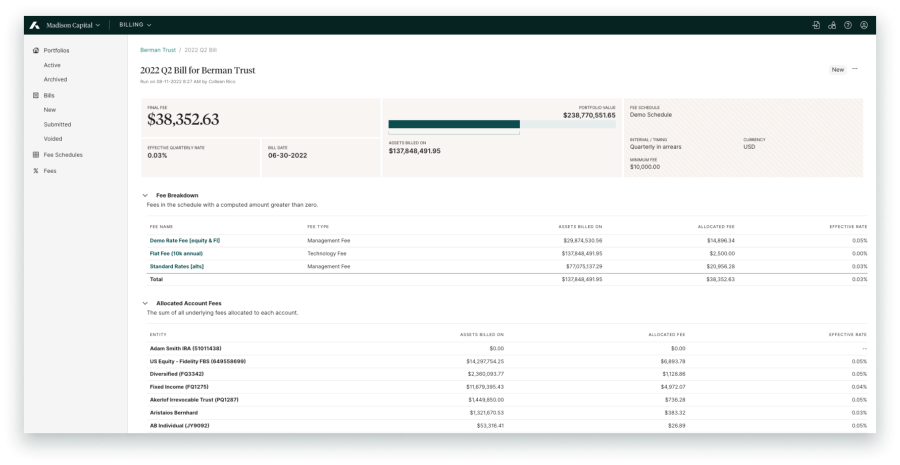

Simplify the calculation, production and tracking of fees, and run and review any bill across all accounts.

Billing summary and fee detail pages offer a more digestible layout and capture granular fee calculations used to generate bills.

Easy onboarding

Rely on our in-house industry experts to understand your firm’s needs and get your firm up and running

Access our on-demand Help Center and online training portal to kickstart your experience

Your data is protected

Addepar utilizes best practice safeguards, including role-based access control and data encryption at rest and in transit.

Stunning mobile and iPad apps make it easy for family members to access portfolios from a smartphone in a secure way, at any time.

Expand your community

Connect with and learn from other exceptional wealth managers around the globe

Participate in regular in-person learning and networking events

Embrace the technology that serves your clients, your team and your business

Addepar was purpose-built to offer greater clarity into and intelligence on the portfolios in your care. Using our complete data aggregation capability and powerful modeling and calculation tools, you can view, model and share portfolio performance with clients in the way that works best – for you and your clients – while reducing drain on your team. Addepar allows you to make smarter decisions, faster, while delivering much more robust guidance.

Addepar named best-in class in 2023 Aite-Novarica RIA Report

Addepar is delighted to be named Best in Class in this year’s Aite-Novarica report – an exciting recognition of our dedication to building innovative products for wealth managers and investment professionals around the globe who seek to deliver exceptional results for the portfolios in their care.

Today, with Addepar, a couple of clicks and it’s done. Further, producing reports, or other supporting materials for client meetings, requires just minutes versus a half day or longer.

Rocio Ortega

WE Family Offices

A picture is worth a thousand words, and Addepar provides that picture to our clients — of their portfolios and of the market.

Isaac Wakszol

AWM

In our view, Addepar is a leading technology solution when it comes to providing reporting for our clients with sophisticated financial needs.

Sal Cucchiara

Morgan Stanley