Published on

Inside Addepar is a quarterly round-up of Addepar platform updates, research insights and client, partner and company news.

In this update, we’re unveiling new platform enhancements, including improved billing workflows, expanded API capabilities, and integrations with Overstone and Etcho. Hear from clients LM Advisors, Belzberg & Co., and Fairman Financial on leveraging technology to strengthen client relationships, and learn how Sage Mountain Advisors optimized alternative investments with Navigator. Plus, we recap our inaugural Addepar Summit and celebrate 15 years of innovation and community. See what’s new from Addepar below.

Product Updates

Billing enhancements

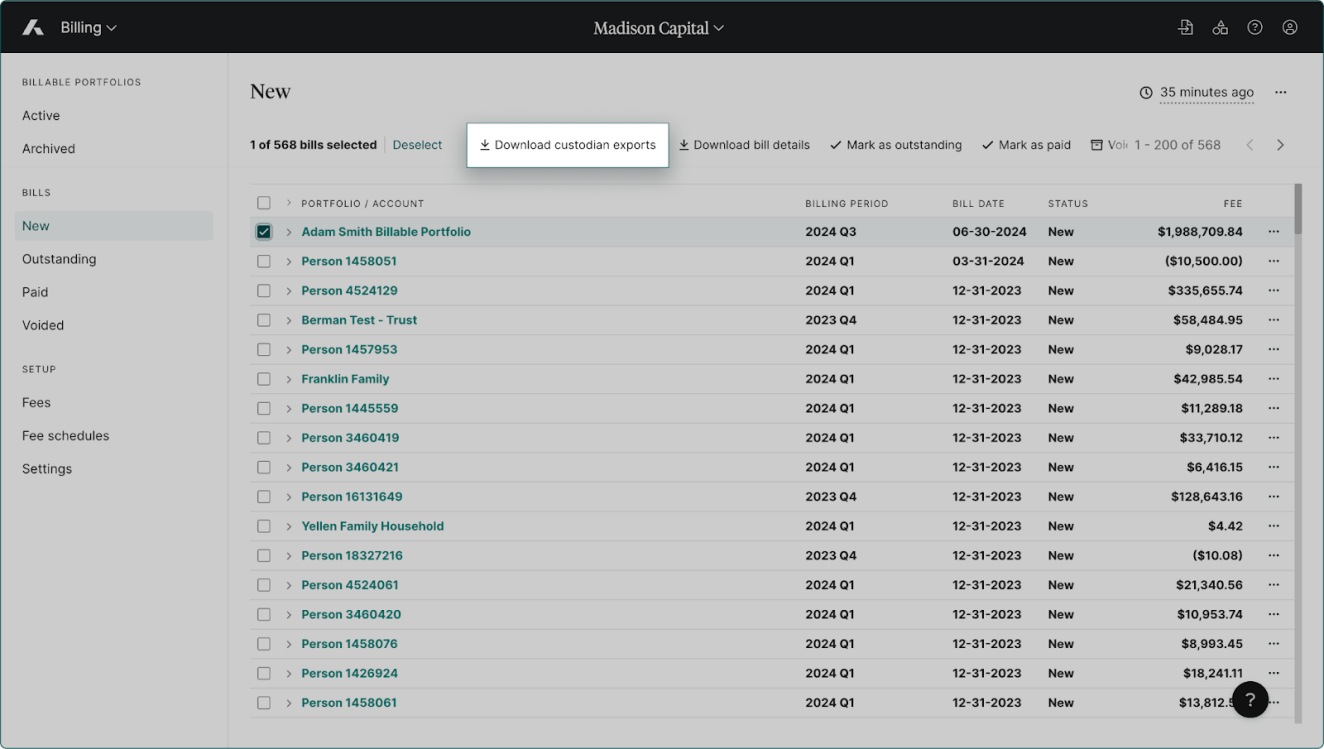

Addepar’s latest billing updates make managing fees more efficient and precise. Users can now download billing data directly in custodian-compatible formats for Pershing and Schwab, eliminating the need for manual formatting. This saves time, reduces the risk of errors and accelerates communication with custodians — enabling faster fee collection. Additionally, downloaded bills now include proration details (except in custodian-formatted files), providing the advanced calculation insights needed for deeper analysis.

Download billing data in custodian formats

Automate daily tasks via API

Addepar’s enhanced APIs simplify automation and data management. New APIs let you run reports, manage transactions and invite portal contacts seamlessly. The Contacts API now supports automated contact creation and default view set assignments. The Import API accelerates data uploads using familiar CSV formats, and the Generated Reports API now filters by portfolio for quicker access to relevant insights.

Specify which portfolio you want to see generated reports for with the Generated Reports API

Addepar clients can review the release notes for details on our latest product updates. Not a client? Contact our team at bd@addepar.com for more information.

What’s Happening Around the Addepar Community

Ecosystem update: This quarter, we’re excited to announce new integrations with Overstone and Etcho. Explore our full list of integration partners, technical details and onboarding instructions in the Addepar Integration Center.

Overstone brings dynamic valuations of art collections into the Addepar platform. Overstone’s AI, combined with insights from experienced art specialists, enables you to monitor and optimize the financial value of your art.

Etcho helps advisors discover what their client uniquely values, tell personalized sustainability stories, and create impactful portfolios — ultimately engaging sustainability-led clients like never before.

Candid insights from our clients: In our latest three-part blog series, we spoke with LM Advisors, Belzberg & Co., and Fairman Financial to get their insights on the value of best-in-class technology and how to use it to create strong foundations for advisors and clients alike.

Exceeding expectations with best-in-class tech: Client expectations are continuously evolving. Learn how advisors at leading RIAs are leveraging best-in-class technology to exceed client expectations and stay ahead.

Paving the way for talent with top-tier tech: How do you attract top advisors? How do you retain them? The answer: better tech. Advisors explain how top-tier technology is elevating efficiency and empowering them to deliver superior service to clients.

Delivering superior client experiences with better tech: Behind every successful client is a committed advisor. Read more on how they’re using technology to create more personalized client experiences at scale.

Transform alternative investment strategies with Navigator: Our latest case study with Sage Mountain Advisors shares the details on how they transitioned from using spreadsheets to Navigator to manage complex alternative portfolios and scale their growing business more effectively. Adopting Navigator addressed their need for consistent, scalable portfolio management tools, particularly in cash flow forecasting and portfolio projections.

Company Updates

In October, we held our inaugural Addepar Summit. Joined on stage by leading RIAs and MFOs, we tackled pressing industry topics like M&A, talent acquisition and the role of AI in advisory teams.

Addepar recently celebrated its 15th anniversary, and we couldn’t be more proud and excited for what lies ahead. This milestone is a testament to the hard work, innovation and dedication that each person at Addepar brings every day, and we are grateful to our broader community of clients and partners for being a part of our incredible journey.

About Addepar

Addepar is a global technology and data company that helps investment professionals provide the most informed, precise guidance for their clients. Hundreds of thousands of users have entrusted Addepar to empower smarter investment decisions and better advice over the last decade. With client presence in more than 45 countries, Addepar’s platform aggregates portfolio, market and client data for over $6 trillion in assets. Addepar’s open platform integrates with more than 100 software, data and services partners to deliver a complete solution for a wide range of firms and use cases. Addepar embraces a global flexible workforce model with offices in Silicon Valley, New York City, Salt Lake City, Chicago, London, Edinburgh and Pune.