Published on

Inside Addepar is a quarterly round-up of Addepar platform updates, research insights and client, partner and company news.

In this Q4 edition, we’re highlighting product enhancements, ecosystem growth and community moments that support more efficient, connected and scalable advisory workflows. This quarter, we introduced updates like streamlined Views management and team-level email branding to deliver a more seamless, consistent experience across the platform. We also introduced new integrations, shared perspectives from clients scaling with Addepar, and connected with our community at industry events, Addepar meetups and our 2025 RIA Summit. Explore the highlights below.

Product Updates

Views management enhancements

We’ve redesigned the Views management experience to eliminate interruptions and help teams work faster. With a new side panel for creating, renaming and configuring Views and View Sets, you can make adjustments without forcing a page reload or losing your place in the workflow. Advisors can stay focused on the analysis or reporting task at hand — reducing friction, maintaining context and accelerating day-to-day review and presentation workflows across the platform.

With improved Views management, make adjustments without page reloads.

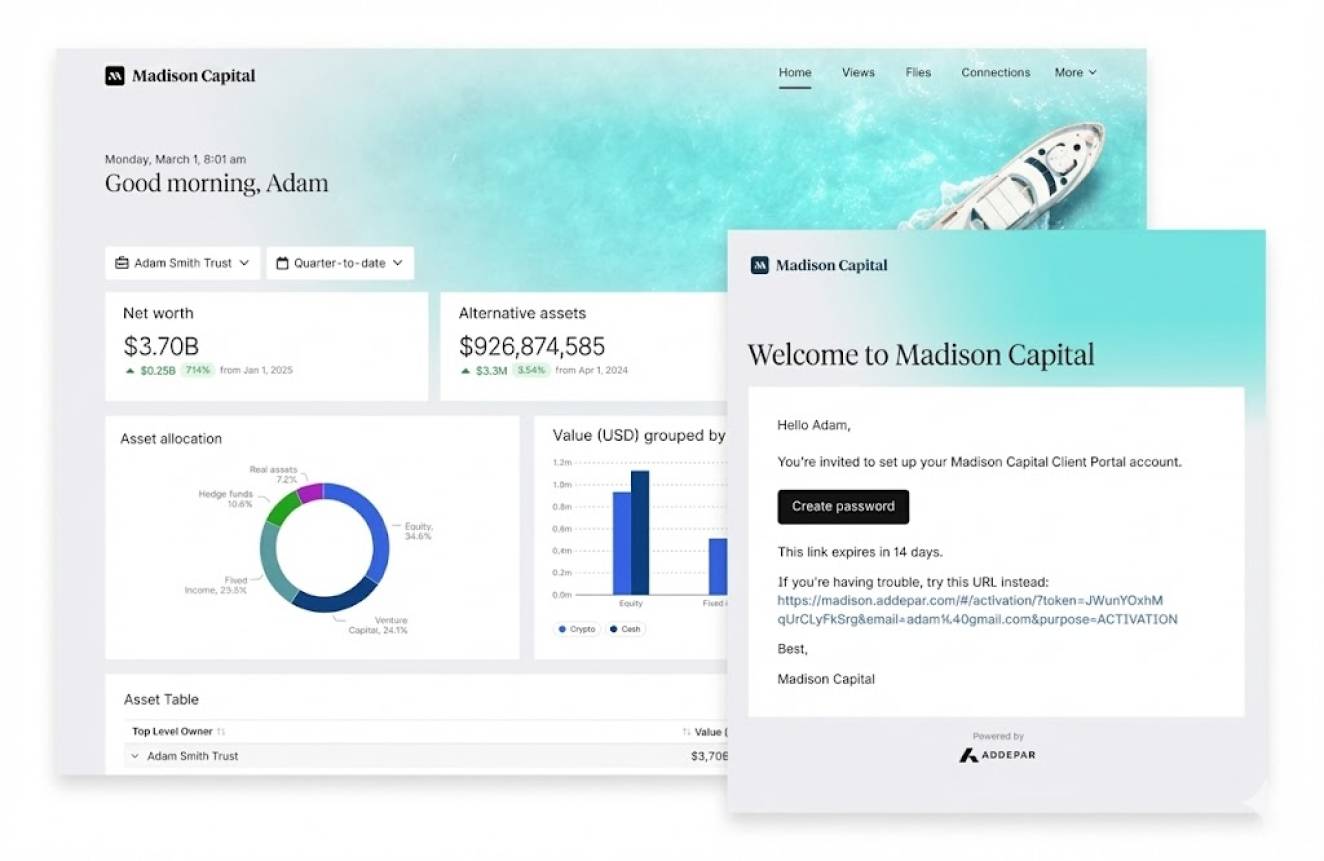

Team-level email branding

To ensure your communications always represent your firm’s identity, we’ve enabled team-level branding within email notifications. Typography, accent colors and design elements defined in your Client Portal now automatically carry through to the inbox, without manual intervention. As you scale, this update strengthens brand integrity across different business units and reduces the risk of off-brand materials reaching clients — creating a more seamless, professional experience from portal to email.

Team-level branding keeps email notifications visually consistent across teams.

What’s happening around the Addepar community

Ecosystem update

We’re excited to announce new integrations with Forest, Dispatch and Composite Builder. Read below or visit our Integration Center to learn more.

Forest Systems: Sync cash and investment data directly between Addepar and Forest’s double-entry general ledger. Transactions update automatically in both systems, minimizing reconciliation work and improving accounting efficiency.

Dispatch: Onboard clients faster and keep records in sync across Addepar, your CRM and key systems. With fewer manual data touchpoints, firms can reduce costly errors and ensure continuously aligned client information.

CompositeBuilder®: Automate composite construction and maintenance using rule-governed workflows. With portfolio attributes, holdings, transactions and performance flowing in from Addepar, teams can support compliance and performance reporting at scale.

Perspectives from our clients

Across our community, firms are modernizing operations and scaling intelligently with Addepar. Explore the full case studies below:

Modum Private Wealth: Modum’s growth story highlights the impact of a tech-first infrastructure. By embedding Addepar at the heart of their operations, the team transformed reporting, streamlined workflows and elevated client transparency — enabling the firm to scale from $10M to nearly $400M in AUA.

Camino Partners: Camino Partners is redefining long-term planning with greater precision. By leveraging Addepar Navigator, the firm built a dynamic, forward-looking view of liquidity across a diverse portfolio, supporting smarter scenario modeling and more informed, values-aligned decisions.

Americana Partners: With Addepar, Americana Partners streamlined client communication and reduced manual effort, empowering its advisors with clearer insights across complex portfolios.

Hear from Addepar experts

Our team continues to share practical guidance on how firms are applying advanced analytics to support better investment decisions.

A forward-looking view with Navigator: In a recent blog, Director of Product Management Rajiv Sharma outlined how Navigator gives advisors a clearer, forward-looking view of cash flows and risk, enabling more confident decisions in dynamic markets.

Alternatives insights: As appetite for alternatives accelerates, this webinar explores how modern data foundations create greater transparency and drive better decision-making across private investments.

Understanding the true drivers of performance: Another webinar highlights how advisors can move beyond basic metrics to gain deeper insight into exposures, risks and the underlying forces shaping portfolio results.

Addepar in-person

In Q4, we found many opportunities to engage directly with clients and partners around the world, highlighting how modern data and workflows are shaping the future of wealth management.

Addepar Community Meetups: We connected with clients in Chicago and São Paulo to discuss AI-enabled workflows, share perspectives on the evolving platform experience and explore how Addepar can support market needs locally and globally.

Schwab IMPACT: In November, Addepar proudly exhibited at Schwab IMPACT, one of the industry’s premier gatherings for independent advisors. Our team connected with hundreds of firms to showcase how Addepar’s unified data platform and cutting-edge analytics help advisors make smarter, more informed decisions for their clients. We also joined forces with Wealthbox and Wealth.com to host a well-attended reception.

Financial Times Global Wealth Management Summit: Addepar CTO Bob Pisani spoke on a panel exploring how wealth managers are redesigning their business models — from building new capabilities in-house to partnering with technology providers to accelerate innovation. Bob shared how data-driven platforms like Addepar enable firms to modernize infrastructure, scale efficiently and deliver a more personalized client experience.

CTO Bob Pisani on stage at the Financial Times Global Wealth Management Summit.

Company Updates

Leadership advancements: Addepar announced Peter O’Brien as Chief Revenue Officer and Janeen France as our first Chief Client Officer, reinforcing our commitment to deepening client partnerships and scaling globally. Read more here.

Expansion in Switzerland: We celebrated the opening of our new Geneva office and were named Wealth Management Technology Provider in Switzerland of the Year at the 10th Annual Private Banking Awards, underscoring our focus on delivering a unified, scalable platform for clients worldwide.

Addepar’s 2025 RIA Summit: Leading RIA firms convened in Napa, California, for our second annual summit, where attendees had the opportunity to discuss how they’re navigating rapid industry transformation. A consistent theme emerged: intentional scale, modern data foundations and technology-enabled workflows are critical to delivering outstanding client outcomes. Read more here.

Addepar’s 2025 RIA Summit in Napa, California.

About Addepar

Addepar is a global technology and data company that helps investment professionals provide the most informed, precise guidance for their clients. Hundreds of thousands of users have entrusted Addepar to empower smarter investment decisions and better advice over the last decade. With client presence in more than 55 countries, Addepar's platform aggregates portfolio, market and client data for over $8 trillion in assets. Addepar's open platform integrates with more than 100 software, data and services partners to deliver a complete solution for a wide range of firms and use cases. Addepar embraces a global flexible workforce model with offices in New York City, Salt Lake City, São Paulo, London, Edinburgh, Pune, Dubai and Geneva.